- Net rental income rose to RM20.36 million for the fourth quarter ended Dec 31, 2024 (4QFY2024), from RM18.76 million in the same period a year earlier, according to the office and commercial property trust’s bourse filing.

KUALA LUMPUR (Jan 21): UOA Real Estate Investment Trust (KL:UOAREIT) posted a 8.55% increase in net rental income for the fourth quarter on improved occupancy.

Net rental income rose to RM20.36 million for the fourth quarter ended Dec 31, 2024 (4QFY2024), from RM18.76 million in the same period a year earlier, according to the office and commercial property trust’s bourse filing.

Gross rental income increased almost 7% to RM29.01 million versus RM27.11 million, while property operating expenses logged a slower 3.46% rise to RM8.65 million from RM8.36 million.

UOA REIT attributed the higher gross rental income to an improved occupancy rate. Its portfolio’s occupancy rate was not disclosed in the filing.

UOA REIT declared a final income distribution per unit of 3.24 sen, payable on Feb 28.

This brought total income distribution for the financial year ended Dec 31, 2024 (FY2024) to 6.14 sen per unit, 21.48% lower than the 7.82 sen declared in FY2023.

Despite the rise in net rental income in 4QFY2024, UOA REIT’s annual net rental income for the financial year ended Dec 31, 2024 (FY2024) declined nearly 10% to RM73.98 million compared to RM82.16 million in FY2023.

Gross rental slipped a marginal 2% to RM110.59 million from RM112.84 million, while property operating expenses expanded 19.3% to RM36.61 million versus RM30.68 million.

Looking to the next financial year, UOA REIT said it expects a gradual improvement in office demand in FY2025.

“The manager [UOA Asset Management Sdn Bhd] will carry on its efforts in improving old assets in the portfolio,” it added.

Units in UOA REIT closed two sen or 2.11% lower at 93 sen, valuing the property trust at RM628.3 million.

EdgeProp.my is currently on the lookout for writers and contributors to join our team. Please feel free to send your CV to [email protected]

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

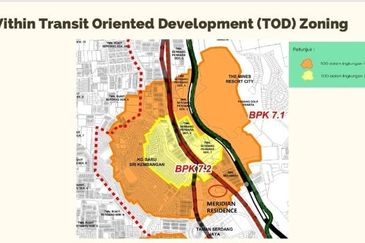

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Taman Perindustrian Bukit Serdang

Seri Kembangan, Selangor

Kawasan Perindustrian Nilai

Nilai, Negeri Sembilan

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Section 19 (Seksyen 19) @ Shah Alam

Shah Alam, Selangor