- Net profit for the third quarter ended Sept 30, 2024 (3QFY2024) rose to RM73.7 million from RM58 million in 3QFY2023, as revenue grew 6% to RM419.3 million from RM395.1 million, largely driven by its hotel business where topline climbed 34% to RM92.4 million, thanks to higher occupancy and room rates.

KUALA LUMPUR (Nov 29): IGB Bhd (KL:IGBB) has declared a dividend payout of 12 sen per share for FY2024 — comprising an interim dividend of seven sen and a special dividend of five sen — as its latest third quarter net profit jumped 27% from the corresponding quarter last year, driven by higher contributions from its retail, commercial and hotel segments.

Net profit for the third quarter ended Sept 30, 2024 (3QFY2024) rose to RM73.7 million from RM58 million in 3QFY2023, as revenue grew 6% to RM419.3 million from RM395.1 million, largely driven by its hotel business where topline climbed 34% to RM92.4 million, thanks to higher occupancy and room rates.

Its commercial property segment saw an 8% increase in revenue to RM56.6 million from RM52.4 million, supported by higher rental income. The retail property segment recorded a modest 4% growth to RM154.1 million from RM148.5 million.

The higher profit raised its earnings per share (EPS) to 5.54 sen from 4.3 sen previously, according to the property developer's bourse filing on Friday. The 12 sen dividend IGB declared — much higher than the seven sen it announced in the January-September period last year — will be paid Dec 20.

For the nine months ended Sept 30 (9MFY2024), IGB's net profit jumped 47.8% to RM334.2 million from RM226.1 million in 9MFY2023, while revenue rose 5% to RM1.23 billion from RM1.17 billion.

IGB expects steady growth in its retail property segment, supported by government initiatives such as visa-free entry for tourists, wage growth policies, EPF flexibility and cash assistance, which are anticipated to boost retail spending.

The group remains "cautiously optimistic" on the commercial property segment despite challenges from office space oversupply, saying demand is now driven by hybrid work trends and a preference for high-quality buildings.

For the hotel segment, IGB anticipates continued recovery through the year, fuelled by increased international arrivals that are supported by initiatives like the Visit Malaysia 2026 campaign, enhanced visa programmes and improved international flight connectivity.

The group also said the launch of Southpoint Residences is expected to attract both local and foreign buyers and contribute to its performance through 2024 and 2025.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Seri Kembangan

Seri Kembangan, Selangor

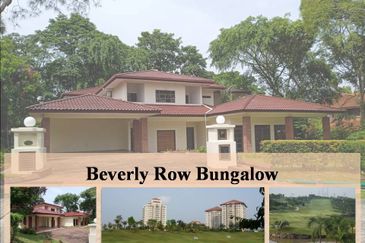

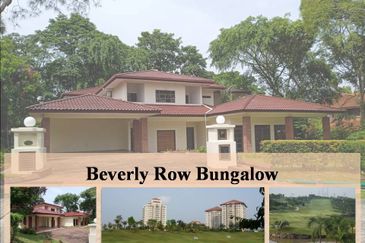

IOI Beverly Row @ IOI Resort City

Putrajaya, Selangor

Aurora Residence @ Lake Side City

Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Section 19 (Seksyen 19) @ Shah Alam

Shah Alam, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Springhill

Port Dickson, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

Kawasan Perindustrian Seri Kembangan

Seri Kembangan, Selangor

IOI Beverly Row @ IOI Resort City

Putrajaya, Selangor

Aurora Residence @ Lake Side City

Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Section 19 (Seksyen 19) @ Shah Alam

Shah Alam, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Springhill

Port Dickson, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan