- As at May 31, 2024, Trive Property’s total issued share capital is RM196.04 million comprising 1.26 billion issued shares. As such, up to 505.46 million warrants may be issued under exercise.

KUALA LUMPUR (June 14): Trive Property Group Bhd (KL:TRIVE) has proposed a bonus issue of warrants on the basis of two warrants for every five existing shares, to reward its shareholders and strengthen its financial position and capital base.

As at May 31, 2024, Trive Property’s total issued share capital is RM196.04 million comprising 1.26 billion issued shares. As such, up to 505.46 million warrants may be issued under exercise.

The warrants, with a tenure of five years, will be issued at no cost to the entitled shareholders. The exercise price of the warrants will be determined at a later date.

Assuming full exercise of the warrants, Trive Property is expected to raise gross proceeds of up to RM25.27 million based on an illustrative price of five sen for each warrant.

Pending the utilisation of proceeds, the group said such proceeds to be raised from the proposed bonus issue of warrants shall be placed in deposits with financial institutions or short-term money market instruments as the board deems fit.

The proposed bonus issue of warrants, subject to approval from Bursa Securities, shareholders and any relevant authority, is expected to be completed by the fourth quarter of this year.

Thrive Property has appointed M&A Securities Sdn Bhd as a principal adviser for the exercise.

Shares of Main Market-listed Trive Property gained one sen or 16.7% to close at seven sen on Friday, bringing it a market capitalisation of RM88 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

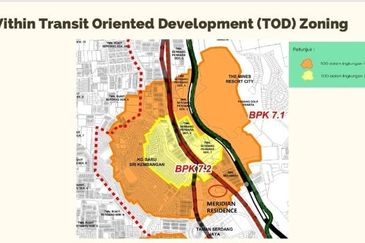

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Taman Perindustrian Kip

Kuala Lumpur, Kuala Lumpur

Semenyih Integrated Industrial Park

Semenyih, Selangor

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

SS 21, Damansara Utama

Petaling Jaya, Selangor

Hillpark 2, Bandar Teknologi Kajang

Semenyih, Selangor