- For 3QFY2024, YTL Power posted a 34.5% year-on-year increase in net profit to RM698.69 million from RM519.64 million, mainly driven by its power generation and investment holding segment, which houses its data centre development operation. Revenue came in slightly lower by 3.7% at RM5.16 billion compared with RM5.36 billion, its bourse filing on Thursday showed.

KUALA LUMPUR (May 24): Shares of utilities-to-hotels conglomerate YTL Corporation Bhd (KL:YTL) and its related stocks on Friday snapped consecutive days of rally despite notching earnings growth in their third quarter (3QFY2024) financial results.

YTL fell as much as 9% while YTL Power International Bhd (KL:YTLPOWR) was down as much as 11.3% during Friday’s trading session. At the time of writing, YTL Corp was trading at RM3.68, down 20 sen or 5.2% from its previous close. YTL Power was trading at RM4.87, down 49 sen or 9.1% from Thursday’s close.

While the majority of institutional analysts remain optimistic about YTL Power, especially its data centre business, at least two institutional analysts have downgraded their calls from “buy” to “hold” following a significant surge in the counter's share price, which has seen it gain over 300% in the past year.

CGS International said the take-up rate for the group’s data centre business needs to increase especially after the market has already factored in its over RM12 billion in value. It pointed out potential downside risks, including execution setbacks and market risks associated with the data centre projects, as well as significant capital expenditure that could elevate gearing.

Nevertheless, it assumed higher earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin of 80% from 65% for the financial year ending June 30, 2027 (FY2027), once capacities of the data centres are fully ramped up with further clarity on the potential profitability of such operations.

Maybank Investment Bank also said that while the market remains bullish on YTL Power’s AI (artificial intelligence) exposure, deployment plans remain fluid and demand-dependent.

Meanwhile, Hong Leong Investment Bank highlighted that the group would see stronger earnings over the next three financial years, driven by an anticipated turnaround in its UK-based wastewater management subsidiary Wessex Water, on top of contributions from its data centres.

“The group has a strong advantage as Nvidia’s preferred partner in Malaysia for AI-Cloud service provider as compared to other data centre owners, as it is difficult and costly to convert a conventional data centre to an AI-data centre infrastructure,” it noted.

Overall, 10 analysts rated YTL Power a "buy", while three have assigned "hold" calls, Bloomberg data showed. The consensus 12-month target price stood at RM6, representing a potential upside of around 23% from its current price of RM4.87.

For 3QFY2024, YTL Power posted a 34.5% year-on-year increase in net profit to RM698.69 million from RM519.64 million, mainly driven by its power generation and investment holding segment, which houses its data centre development operation. Revenue came in slightly lower by 3.7% at RM5.16 billion compared with RM5.36 billion, its bourse filing on Thursday showed.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

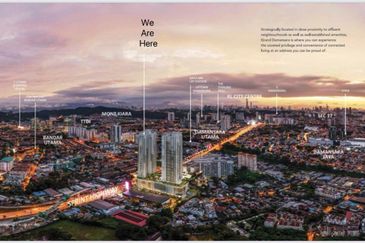

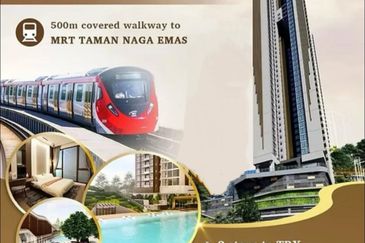

Amber Residence @ twentyfive.7

Kota Kemuning, Selangor

Pangsapuri Kasuarina

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Lagoon View Resort Condominium

Bandar Sunway, Selangor

Cemara Damai Residences @ Alam Damai

Cheras, Kuala Lumpur

Seksyen 12, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor