- The group said the issuance was undertaken in three tranches: RM200 million first tranche with a five-year tenure maturing on Feb 12, 2029; RM100 million second tranche with a seven-year tenure maturing on Feb 14, 2031; and RM200 million third tranche with a 10-year tenure maturing on Feb 14, 2034.

KUALA LUMPUR (Feb 14): UEM Sunrise Bhd has issued Islamic medium-term notes (IMTNs) worth RM500 million in nominal value.

The group said the issuance was undertaken in three tranches: RM200 million first tranche with a five-year tenure maturing on Feb 12, 2029; RM100 million second tranche with a seven-year tenure maturing on Feb 14, 2031; and RM200 million third tranche with a 10-year tenure maturing on Feb 14, 2034.

The notes were part of UEM Sunrise’s IMTN programme, which together with an Islamic commercial papers programme, have a combined aggregate limit of up to RM4 billion, said the group in a bourse filing.

UEM Sunrise said the proceeds from the new IMTNs will be used for the group’s shariah-compliant general corporate purposes.

This includes the acquisition of new landbank, companies, investments, project development and infrastructure cost, capital expenditure, general expenditure, and refinancing of Islamic financing or outstanding loan facilities.

Shares in UEM Sunrise ended unchanged at RM1.06 on Wednesday, giving the group a market capitalisation of RM1.06.

UEM Sunrise is one of EdgeProp START’s strategic partners. The MINH in Mont’Kiara is a development highlighted in this partnership. All UEM Sunrise homebuyers also get to enjoy rewards worth up to RM18,888.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

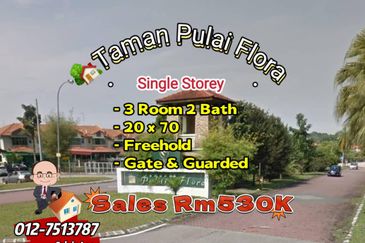

Prima Regency (Dorchester Court)

Plentong, Johor