- Research houses said the group's financial earnings for the quarter came in within their expectations, thanks to all segments of the group, particularly its hotel and management segments, showing strong financial performance for the quarter.

KUALA LUMPUR (Nov 29): Analysts have shrugged off any potential impact on KLCCP Stapled Group's prospects by the opening of the The Exchange TRX mall as well as inflationary pressures.

In a research note, CGS-CIMB said the group's Suria KLCC mall is unlikely to be impacted by the recently opened rival mall, as it is a part of the iconic KLCC Twin Towers.

"Backed by the government's efforts to spur tourist arrivals and the upcoming holidays, we expect positive momentum for hotel and retail segments to persist into 4QFY2023 (fourth quarter of ended Dec 31, 2023)," it said.

Meanwhile, Kenanga Research said Suria KLCC's target markets are less susceptible to inflationary challenges, as demonstrated by the higher moving annual turnover of its tenants.

Overall, the research house is upbeat on the real estate investment trust's (REIT) prospects for 4QFY2023, thanks to the upcoming festivities.

"With businesses now operating close to pre-pandemic levels, the earnings pattern seen in 9MFY2023 (nine-month period ended Sept 30, 2023) is expected to hold up in the coming quarters.

"Year-on-year, retail footfall climbed by 39%, indicating that consumer spending is likely to remain robust.

"We opine that forward earnings will continue to be supported by: (i) the office division’s high occupancy rate (100% at end-September 2023, given its long-term, locked-in leases with high-quality tenants), (ii) the retail division’s eight new tenants that increased the mall’s occupancy rate during 3QFY2023, (iii) the hotel operation’s stride to hopefully break even in the medium term as the occupancy ratio picks up (52% from circa 62% prior to Covid-19), as well as (iv) the management services’ improved performance during the quarter with the rise in transient (up 8% y-o-y) and season car park customers (11% y-o-y)," it said.

Kenanga Research said KLCCP has also expressed interest in exploring global assets to add to its portfolio, but it will prioritise improving the efficiency of its local operations first.

HLIB Research said it expects KLCCP to finish FY2023 with a decent showing, thanks to the strong performance of its hotel and mall, which will be buoyed by the Christmas and New Year celebrations, coupled with full occupancy of its offices.

MIDF Research said the REIT's earning prospects remain steady as higher tourist arrivals will support its retail and hotel businesses.

"Meanwhile, contribution from office will remain stable going forward due to long lease agreement. Nonetheless, upside is limited, hence we maintain our 'neutral' call on KLCCP. Meanwhile, dividend yield is estimated at 5.1%," it said.

MIDF Research also kept its target price (TP) for the stock at RM7.08, based on the dividend discount model.

HLIB Research has maintained its ‘hold’ rating on KLCCP, with a higher TP of RM6.89 (previously RM6.68) based on financial year 2024 (FY2024) distribution per unit (DPU) on targeted yield of 5.7%, derived from five-year historical average yield spread between KLCC REIT and 10-year Malaysian government securities (MGS).

Kenanga Research, however, downgraded the group to ‘market perform’ with unchanged TP at RM7.18 based on its forecast FY2024 gross DPU of 39.5 sen against an unchanged target yield of 5.5% (derived from a 1.5% yield spread above its 10-year MGS assumption of 4.0%).

HLIB Research projected the group's hotel segment, which returned to profitability after 10 consecutive quarters of losses since 4QFY2019, to maintain its strong performance into 4QFY2023, buoyed by the uptick in travel and leisure activities during on the upcoming Christmas and New Year holiday season.

Following this, the research house raised its earnings forecast for KLCCP by 4.7% for FY2023, 3.2% for FY2024, and 3.2% for FY2025, as it factored in higher hotel occupancy rate and management services contribution.

In addition, HLIB Research also increased its DPU estimates to 37.5 sen for FY2023, 39.3 sen for FY2024, and 40.8 sen for FY2025, implying a dividend yield of 5.4% for FY2023, 5.6% for FY2024, and 5.9% for FY2025.

On Tuesday, KLCCP reported that its net profit for 3QFY2023 rose 4.96% to RM185.34 million in 3QFY2023, with revenue up 7.27% to RM401.16 million.

For 9MFY2023, its net profit rose 8.65% to RM546.7 million, underpinned by 12.48% revenue growth to RM1.18 billion.

All the research houses said the group's financial earnings for the quarter came in within their expectations, thanks to all segments of the group, particularly its hotel and management segments, showing strong financial performance for the quarter.

At the time of writing, KLCCP’s units traded higher to 50 sen or 0.72% at RM7. It market capitalisation stood at RM12.64 billion.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Taman Subang Indah PJS 10

Bandar Sunway, Selangor

Kemuning Utama Commercial Centre

Shah Alam, Selangor

Anggerik Doritis @ Kota Kemuning

Shah Alam, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Setia Damai

Setia Alam/Alam Nusantara, Selangor

Aster Grove Residences Park

Shah Alam, Selangor

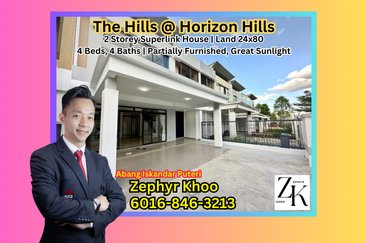

The Hills @ Horizon Hills 2 Storey Superlink House

Horizon Hills, Johor

ECO BUSINESS PARK 5

Bandar Puncak Alam, Selangor

Semi D Corner Subang Bestari U5

Subang Bestari, Selangor