- “On mortgage space, we understand that many homeowners are turning to green living not just to cut their carbon footprints but for savings as well. Popular among landed home properties are solar panels installed on rooftops, which are capable of saving 54% to 87% per month on electricity bills.”

As the world pursues sustainability in every aspect of life, the banking industry is not left behind, and in fact, may be among the leaders.

In line with this, AFFIN Group has remained committed to integrating sustainability practices into the delivery of its products and services.

The Group’s vision is clear – to be the “Most Creative Financial Company In Malaysia” with its AFFIN2025 (A25) strategies towards the next chapter of growth and expansion via three main pillars:

1. Unrivalled customer service

2. Digital leadership

3. Responsible banking with impact – in line with Environment, Social and Governance (ESG) standards.

As a modern and progressive financial group that subscribes to creativity and innovation, sustainability is at the core of all that it does. Under the Group’s Responsible Banking with Impact A25 strategic objectives, it targets up to 10% ESG financing or loan portfolio.

“We have achieved around 3.8% of the target in the first quarter of 2023, which is an encouraging start to our ESG financing initiative,” managing director, Mortgage Business, Group Community Banking, AFFIN Bank, Jessie Wong (pictured) tells EdgeProp.my.

“On mortgage space, we understand that many homeowners are turning to green living not just to cut their carbon footprints but for savings as well. Popular among landed home properties are solar panels installed on rooftops, which are capable of saving 54% to 87% per month on electricity bills.

In support of this renewable energy practice, AFFIN Bank has launched the AFFIN Solar Financing-i to help smart homeowners who are keen on purchasing solar panels to generate the electricity they need.

Solar panels can cost RM20,000 to RM60,000, depending on rooftop, quality, grade, etc, Wong points out.

AFFIN Solar Financing-i offers competitive financial packages to finance this need, either through fixed profit rate or variable profit rates with a repayment period up to 120 months. Alternatively, you can also opt for AFFIN Bank Credit Card – EPP (Easy Payment Plan).

Borrowers will also get to choose from AFFIN’s panel of 14 reputable solar providers.

Read also: Home loan that fits your pocket

EdgeProp START has partnered with AFFIN Bank to offer homebuyers a RM100 IKEA gift card when they sign up for AFFIN Home Step Fast.

Explore more exclusive rewards and vouchers for your dream home when you sign in to EdgeProp START.

TOP PICKS BY EDGEPROP

Nusa Cemerlang Industrial Park

Gelang Patah, Johor

Nusa Cemerlang Industrial Park

Gelang Patah, Johor

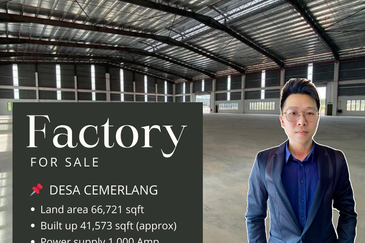

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor