- "It offers a practical solution for EPF members who are facing temporary liquidity issues by providing cash flow through personal financing but with minimal impact on their retirement savings," the EPF said.

- This facility is targeted towards EPF members who have savings in their Account 2, the EPF said, and are "supported with a reasonable income to ensure they can afford the financing and repay it without compromising their retirement income adequacy and security".

KUALA LUMPUR (April 3): Eligible members of the Employees Provident Fund (EPF) who are aged 40 and above may apply for personal financing from banking institutions using their Account 2 balance as support for their loans from April 7, subject to the readiness of participating banks, under the pension fund's "Account 2 Support Facility" programme.

This is the first phase of the two-phase programme, and will remain open for one year. The second start date for Phase 2 for members under 40 years of age will be announced in due course, the EPF said in a statement.

"The maximum financing amount has been fixed at RM50,000, subject to the EPF Account 2 balance, with a repayment tenure of up to 10 years. The interest rate (conventional) or profit rate (Islamic) to be charged by the participating banks under this programme will range from 4% to 5%, lower and more affordable than the current market rate of 8% to 15%," the EPF said.

Under the facility, all Malaysian EPF members below the age of 55 can submit an advance notice for Age 50 or Age 55 conditional withdrawal for repayment of the financing obtained, provided they have a minimum amount of RM3,000 in their Account 2.

This means the withdrawal will only be made to the banking institution when the member reaches the age of 50 or 55, as stipulated in the EPF Act 1951, it said.

"If a member makes an advance notice for Age 50 withdrawal, the EPF will pay the principal and accumulated dividends from Account 2 into the member’s financing account with the bank, at any age between 50 and 54, as chosen by the member, subject to the maximum tenure of up to 10 years.

“If the member opts for Age 55 withdrawal, the EPF will pay the principal and accumulated dividends from Account 2 into the member’s financing account with the bank at age 55. The amount paid will first be used to settle the remaining personal financing balance, if any, before returning any excess to the member,” the pension fund explained.

This way, savings will remain intact in members' Account 2 and continue to receive annual EPF dividends, hence allowing members to take advantage of the power of compounding their retirement nest egg, while still addressing their short-term financial needs, the EPF said.

“If a member fully settles their personal financing, they can notify the EPF to rescind their advance notice of Age 50 or Age 55 withdrawal. Once the notice is rescinded, the amount applied for withdrawal (principal and accumulated dividends) in Account 2 can be utilised for other pre-retirement withdrawals from the EPF,” it added.

Apply through participating banks

Members who meet the eligibility criteria may apply through participating banks, including MBSB Bank and Bank Simpanan Nasional. "The EPF may consider adding more participating banks in the future," it said.

"The banks will fully administer the application process for personal financing through this facility, subject to their financing assessment and credit framework. The personal financing application can be completed online through participating banking institutions.

"Before applying, members need to ensure their eligibility in EPF Account 2. The application should be submitted according to the agreed terms and conditions with the banking institution. Once approved, members can submit an initial application for Age 50 or Age 55 conditional withdrawal to the EPF based on the approved financing amount," the statement read.

This facility is targeted towards EPF members who have savings in their Account 2, the EPF said, and are "supported with a reasonable income to ensure they can afford the financing and repay it without compromising their retirement income adequacy and security".

"It offers a practical solution for EPF members who are facing temporary liquidity issues by providing cash flow through personal financing but with minimal impact on their retirement savings," the EPF said.

Last month, Prime Minister and Finance Minister Datuk Seri Anwar Ibrahim announced that the government had given the greenlight to the EPF to allow its members to use their Account 2 savings as a support for bank loans to tide them through difficult times.

TOP PICKS BY EDGEPROP

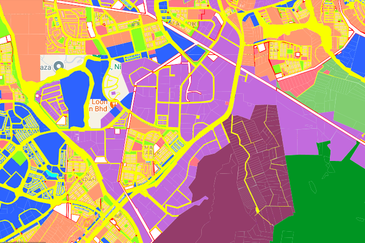

Taman Perindustrian Meranti Jaya

Puchong, Selangor

FREEHOLD Zoning Industrial Land For Sale | Kawasan Perindustrian Nilai 3 2 Pajam Arab Malaysian Industrial Park Nilai Utama Enterprise Park

Nilai, Negeri Sembilan

Eco Nest @ Eco Botanic

Iskandar Puteri (Nusajaya), Johor

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

Sri Teratai Apartment

Bandar Kinrara Puchong, Selangor