- Economists believe the government is unlikely to slash subsidies abruptly in Malaysia, especially those regarding electricity and petrol.

- This, combined with easing supply chain disruptions, ceteris paribus, will cool down the inflation, they said.

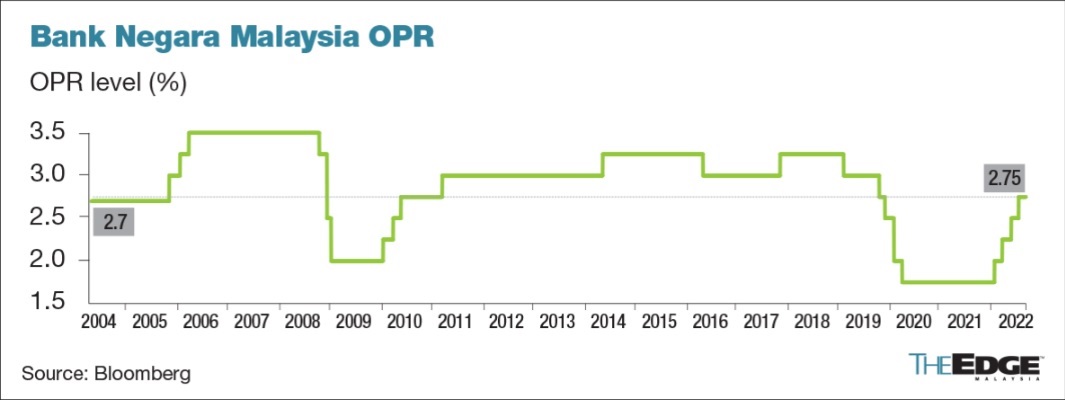

KUALA LUMPUR (Dec 29): Economists, in general, are keeping their view that Bank Negara Malaysia (BNM) will raise the overnight policy rate (OPR) by another 50 basis points (bps) to 3.25% in 2023, amid expectation that inflationary pressure will ease.

They believe the government is unlikely to slash subsidies abruptly in Malaysia, especially those regarding electricity and petrol. This, combined with easing supply chain disruptions, ceteris paribus, will cool down the inflation, they said.

At 3.25%, the OPR will be back to pre-pandemic levels. The benchmark interest rate now stands at 2.75%, after four consecutive hikes of 25 bps from 1.75% at the start of 2022, amid global monetary authorities' efforts to tighten liquidity to tame inflation driven by post-pandemic pent-up demand and supply chain disruptions.

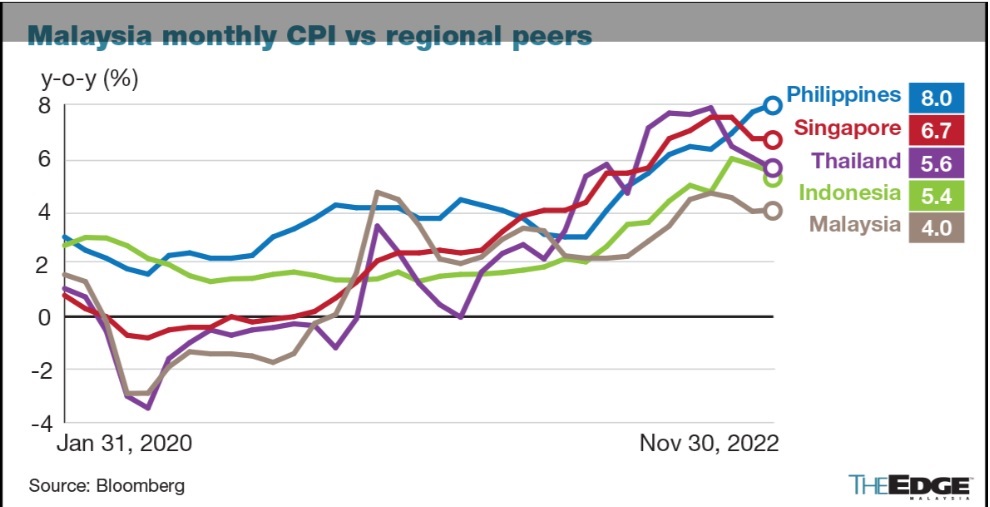

Assuming no changes in domestic policy particularly fuel and electricity subsidies as well as price cap for staple food, UOB Global Economics & Markets Research senior economist Julia Goh said the consumer price index (CPI) should continue on its downtrend going into 2023 and is projected to average 2.8% from an estimated 3.5% in 2022.

This compares to the Ministry of Finance's forecast in October of 2.8%-3.3% inflation for 2023.

"As core inflation remains elevated, this signals the persistence of demand-pull price pressures along with higher wages. Hence, we reiterate our view for another two 25 bps hikes in OPR to 3.25% in the first quarter of 2023 (1Q2023).

"This would bring rates to pre-pandemic levels which are not over restrictive [on economic growth]. Thereafter, we expect rates to stay on hold for the rest of the year," she said.

Kenanga Economic Research expects BNM to slow down rate hikes in 2023, although it pointed out that core inflation remains persistently high currently on the back of strong domestic demand.

BNM may raise the OPR by another 25 bps in January 2023, to further realign with global monetary tightening trends and to curb persistently elevated core inflation, the research house said.

"However, due to growing global economic uncertainty and a potential domestic slowdown later in the year, we currently assign only a 50% probability of another similarly sized rate hike in March.

"As such, we reckon the terminal rate would be between 3% and 3.25%, in line with the long-term OPR average, after which we expect BNM to keep it unchanged for the rest of 2023," it said.

It is worth noting that Malaysia's CPI still lags behind regional peers due mainly to the blanket subsidies on fuel, utilities as well as price control for necessary consumer foods like chicken and eggs.

Malaysia's core inflation rose to a new high of 4.2% in November, driven by robust consumer demand and an improving job market. Headline CPI growth rose as much as 4.7% in August, before tapering off to 4% in November.

According to Bloomberg data, the consensus estimate for Malaysian CPI is 3% in 2023, based on estimates of 31 economists.

"Core CPI would need to moderate in the coming months before we can safely say that price pressures have subsided and before headline inflation can return to below 3%," Kenanga said.

It expects headline inflation to ease to 2.5% in 2023 as the new government prioritises tackling the rising cost of living and continues to provide blanket subsidies in the near term, before implementing target subsidies in the second half of 2023 (2H2023).

"Our core CPI forecast for 2023 is 2.3%, as we expect core inflation to subside to below 3% by 2Q2023 due to a drop in prices for imported inputs due to the strengthening ringgit, slowing global demand, and supply chain normalisation," it said.

However, there is a handful of economists forecasting OPR to surpass pre-pandemic levels of 3%-3.25%.

RHB Research expects OPR to peak at 3.5% and that it would materialise sooner rather than later, possibly by 1H2023, implying three more 25 bps hikes by BNM.

"Our view is anchored on the decent economic performance so far as well as still elevated inflationary pressures," said the firm's economist Chin Yee Sian and analyst Wong Xian Yong when contacted.

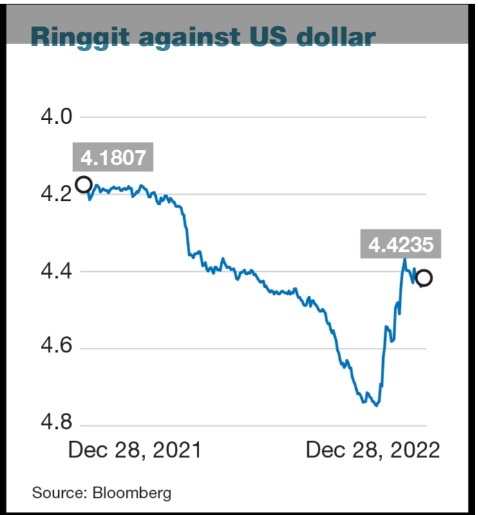

"Moving forward, we expect the trajectory of the inflation to be continued driven by a few factors, i.e. the momentum of economic growth, the strength of ringgit, [and] the movement of commodity prices," they said, forecasting a 3% headline inflation for 2023 and a strengthening of the ringgit to 4.20-4.30 range against the US dollar by the end of 2023.

'Ringgit highly correlated with renminbi movements'

Commenting on the ringgit, UOB's Goh said potential domestic catalysts for the local currency include political resolution that paves the way for pro-growth policies, domestic reforms, and further OPR hikes.

"[Another] key external factor that could impact the ringgit is the trend of the China renminbi. We note that the ringgit highly correlated with movements of the renminbi against the US dollar from April till about mid-November.

"At this juncture, it remains to be seen if returning confidence in Malaysia's markets will be enough to overcome the drag of a weakening renminbi. For now, we maintain an upward trajectory for [US dollar/ringgit], similar to that of [US dollar/renminbi]," she said.

Goh expects the ringgit to weaken against the greenback in 2023. Her US dollar/ringgit forecasts are at 4.55 for 1Q2023, 4.60 for 2Q2023 and 4.65 for 2H2023.

However, Kenanga's forecast is the reverse of Goh's.

Kenanga expects the ringgit to start the year of 2023 on a soft note as the US Federal Reserve (Fed) is seen likely to tighten liquidity, and to regain strength towards the later part of the year as China recovers from the Covid-19 impact.

Kenanga foresees the local note to strengthen further to 4.11 by the end of 2023, primarily due to expectation of the Fed trimming interest rates coupled with a potential rebound in commodity prices.

However, Kenanga cautioned that an escalation in the Russia-Ukraine war, a U-turn in China's Covid-19 policy, a persistently hawkish Fed resulting in no rate cuts in 2023 and deepening China-Taiwan tensions may shift the ringgit's bullish narrative.

"In the first few months of 2023, the ringgit is expected to reverse the gains made in 4Q2022 and depreciate against the US dollar to around 4.48 (end-1Q2023), mainly due to the increasing monetary policy divergence between the BNM and the Fed, as the [Fed] may continue to hike above 5% while the [BNM] could stop short of 3%.

"However, moving into 2Q2023, the eventual reopening of China and Malaysian government's increasingly pro-investor policies may help boost the ringgit back to around the 4.35 level," the research firm said.

TOP PICKS BY EDGEPROP

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

The Borough @ Eco Botanic 2

Iskandar Puteri, Johor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Taman Nanyang (Nanyang Estate)

Jinjang, Kuala Lumpur