- “Our residential launches achieved encouraging demands including Serenia City’s ‘Serenia Anira 3’ with 80% take-up, while the semi-detached and detached factories in Elmina Business Park achieved 100% take-ups showing our capability in catering to the needs of businesses of any scale with solutions ranging from ready-built factories to customisable built-to-lease industrial properties.”

KUALA LUMPUR (Nov 29): Sime Darby Property Bhd (SDP) net profit for the third quarter ended Sept 30, 2022 (3QFY2022) surged to RM56.13 million from a net loss of RM5.19 million a year earlier on the back of higher revenue.

In a bourse filing on Tuesday (Nov 29), SDP said revenue grew by 12% to RM689.3 million quarter-on-quarter driven by improvements in the property development segment, which registered higher revenues of 13% to RM640.6 million on the back of steady progress of its land bank management and monetisation plan.

Earnings per share were 0.80 sen versus loss per share of 0.10 sen previously.

For the cumulative nine months ended Sept 30, 2022 (9MFY2022), SDP’s net profit jumped to RM212.69 million from RM84.13 million, on the back of higher revenue of RM1.78 billion versus RM1.48 billion previously.

In a separate statement, SDP said it has exceeded its RM2.6 billion FY2022 sales target by achieving RM2.7 billion sales in 9MFY2022.

It said this marked a 43% year-on-year increase from the RM1.9 billion sales achieved in the corresponding period in FY2021.

SDP group managing director Datuk Azmir Merican said that the group’s strong sales momentum from the start of the year which continued into 3QFY2022 is a key indicator of earnings potential towards the end of the financial year.

“We are encouraged by our strong performance for the year-to-date despite the macro headwinds and market challenges.

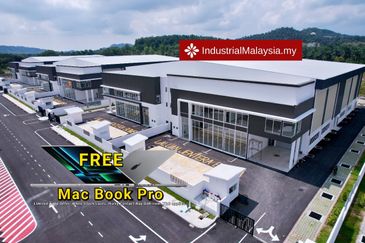

“Our residential launches achieved encouraging demands including Serenia City’s ‘Serenia Anira 3’ with 80% take-up, while the semi-detached and detached factories in Elmina Business Park achieved 100% take-ups showing our capability in catering to the needs of businesses of any scale with solutions ranging from ready-built factories to customisable built-to-lease industrial properties,” he said.

On its outlook, SDP said it is anticipating further launches across residential and industrial segments in 4QFY2022 alongside the return of new high-rise residential products in Putra Heights, Selangor and Taman Melawati, Kuala Lumpur.

“On the back of increasing land activation and launches, the Group continues to demonstrate its financial strength as supported by its cash position of RM876.2 million and net gearing ratio of 28.2% as at Sept 30,” it said.

Azmir said SDP has maintained healthy financial and operational performances despite the economic and market uncertainties.

“Our achievements indicate that the group is on the right course of action with our strategies, product developments and offerings.

“We will maintain the discipline to end the year on a high note and deliver greater returns for our shareholders” he said.

TOP PICKS BY EDGEPROP

Seksyen 6, Kota Damansara

Kota Damansara, Selangor

Kawasan Perusahaan Sesama

Batu Caves, Selangor

Rawang Corporate Industrial Park

Rawang, Selangor

Mutiara Oriental Condominium

Petaling Jaya, Selangor