- The real estate investment trust (REIT) said distributable income for the quarter amounted to RM22.2 million or a distribution per unit (DPU) of 1.01 sen, while revenue rose 45.87% to RM71 million compared with RM48.68 million on the back of the continued improvement in retail sentiment and the absence of rental relief.

KUALA LUMPUR (Oct 26): CapitaLand Malaysia Trust's (CLMT) net property income (NPI) for the third quarter ended Sept 30, 2022 (3QFY22) swelled two-fold to RM38.21 million from RM18.57 million a year prior, in line with higher revenues across all its properties.

In a statement on Wednesday (Oct 26), the real estate investment trust (REIT) said distributable income for the quarter amounted to RM22.2 million or a distribution per unit (DPU) of 1.01 sen, while revenue rose 45.87% to RM71 million compared with RM48.68 million on the back of the continued improvement in retail sentiment and the absence of rental relief.

Commenting on the results, CapitaLand Malaysia REIT Management Sdn Bhd (CMRM) chairman Lui Chong Chee said CLMT's stronger earnings in the quarter were in line with the overall recovery of the nation's retail sector, boosted by the lifting of the Covid-19 pandemic restrictions and reopening of international borders.

CMRM chief executive officer Tan Choon Siang concurred and said that the results were driven by better operating performances across all properties in the REIT's portfolio.

"Sustaining the positive momentum from the preceding quarter (2QFY22), portfolio sales for 3QFY22 continued to trend above the average pre-pandemic level in 2019, while portfolio occupancy as at Sept 30, 2022 rose to 83.1%," he said, noting that the higher occupancy rate was underpinned by a newly secured supermarket anchor tenant for 3 Damansara.

For the nine months ended Sept 30, 2022 (9MFY22), CLMT logged a cumulative NPI of RM111.71 million, a 59.78% increase from the RM69.91 million the REIT achieved in 9MFY21.

Cumulative distributable income surged to RM64.27 million or a DPU of 2.96 sen, from RM21.34 million (1.01 sen per unit) in the same period last year, while revenue climbed 30.92% to RM206.92 million from RM158.05 million.

Going forward, Lui said that while steady demand is expected to sustain the Malaysian economy's recovery for the rest of 2022, the REIT is cognisant that increasing global macroeconomic uncertainties may ease the momentum.

"To this end, CLMT will remain proactive in maintaining healthy portfolio occupancy and sustainable rental income while ensuring cost efficiencies and keeping a lookout for opportunities to diversify income streams," he added.

Additionally, Tan said that the REIT expects to complete the acquisition of its first logistics asset, which is "located in a well-established industrial hub in Sungai Jawi, Penang", in 4QFY22.

"The acquisition marks the start of CLMT's strategy to invest in well-connected and high-quality industrial and logistics assets in key regions, which offer stable income growth, supported by Malaysia's growing importance as a regional hub.

"With our healthy balance sheet, we are actively exploring yield-accretive investment opportunities, be it in existing or new asset classes, in pursuit of inorganic growth," he said, but noted that the REIT will be prudent in its capital management in view of the macroeconomic uncertainties.

Units of CLMT ended half a sen or 0.96% higher at 52.5 sen on Wednesday, valuing the REIT at RM1.16 billion.

TOP PICKS BY EDGEPROP

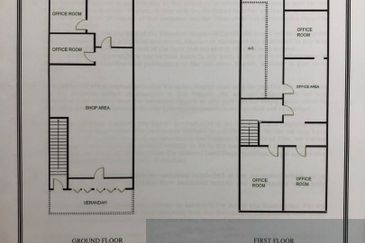

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Jalan Suasana, Bandar Tun Hussein Onn

Batu 9th Cheras, Selangor