- Majuperak said the proposed acquisition represents a strategic investment for the group to be entitled for the future income streams arising from the property management services carried out by AGPS and AGPSP.

KUALA LUMPUR (Aug 2): Majuperak Holdings Bhd, a 51.41%-owned subsidiary of Perak State Development Corp, has struck a deal to acquire a substantial stake in two property management companies as part of a plan to regularise its financial condition and turnaround the group.

In a bourse filing on Tuesday (Aug 2), Majuperak said it has signed a share sale agreement (SSA) with sellers, namely Cheong Mee Yoke, Teoh Oo Seng and Tan Keng Heng, to acquire 49% equity interest in Allied Group Property Services Sdn Bhd (AGPS) and Allied Group Property Services (Penang) Sdn Bhd (AGPSP) for RM9.8 million cash. This follows the signing of a term sheet between the two parties for the proposed acquisition on March 30.

Majuperak said the proposed acquisition represents a strategic investment for the group to be entitled for the future income streams arising from the property management services carried out by AGPS and AGPSP.

"The proposed acquisition would also allow Majuperak to have a footprint in the Klang Valley and Northern Region, thus utilising the capabilities of the two companies to expand the market in Perak as well," Majuperak said, adding that the combination with its existing business will provide economies of scale to support its business expansion and have a competitive advantage in the facilities management industry.

Under the terms of the acquisition, the three sellers will provide a total guaranteed pre-tax profit to Majuperak of RM1.6 million and RM2.2 million for the first and second year from the completion date of the SSA. Based on its 49% equity interest, the pre-tax profit attributable to Majuperak would be RM784,000 for the first year and RM1.08 million for the second year.

The proposed acquisition is estimated to be completed within 60 days from the date of the agreement. Majuperak said it will fund the proposed acquisition from internal funds and/or equity fundraising.

AGPS and AGPSP are involved in property management services. Among the facilities management projects AGPS has in hand include Tijani 1 Bukit Tunku, Fortune Perdana, Reizz Residence and Mont' Kiara Sophia in Kuala Lumpur, while AGPSP manages Horizon Tower, Iconic Vue, Northam Venture and Orange Regency in Penang.

Majuperak posted a net profit of RM116,000 in the first quarter ended March 31, 2022, a 93% decline from RM1.67 million recorded a year ago, as revenue fell 57% to RM5.84 million, from RM13.45 million during the same period.

In April 2020, Majuperak was classified as an affected issuer after it triggered Paragraph 8.03A(2)(b) of Bursa Malaysia's listing requirements, as its unaudited financial statements for the financial year ended Dec 31, 2019 showed that it had an insignificant business or operations.

The stock was untraded on Tuesday. It last closed at 30 sen on July 29, bringing a market capitalisation of RM85.33 million.

TOP PICKS BY EDGEPROP

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

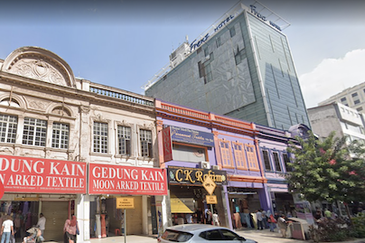

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur