- Revenue for 4QFY22 fell 0.9% to RM19.2 million, from RM19.4 million previously.

- KIP REIT declared a distribution per unit (DPU) of 2.1 sen, to be paid on Aug 25.

KUALA LUMPUR (July 29): KIP Real Estate Investment Trust (KIP REIT)’s net property income (NPI) for the fourth quarter ended June 30, 2022 (4QFY22) dropped 5.8% to RM14.2 million, down from RM15.08 million a year ago, due to higher utilities expenses and lower gross revenue.

According to the company’s local bourse filing on Thursday (July 28), its revenue for 4QFY22 fell 0.9% to RM19.2 million, from RM19.4 million previously. Its utilities expenses increased by 30.3% to RM2.22 million from RM1.7 million, when compared to its corresponding quarter in 2021 (4QFY21).

However, the REIT declared a distribution per unit (DPU) of 2.1 sen, to be paid on Aug 25. The company recorded more than five times growth for its profit after tax (PAT) to RM49 million in 4QFY22, from RM9.27 million in 4QFY21. The total PAT is made of realised and unrealised PAT of RM9.5 million and RM39.5 million respectively.

In a press statement, KIP REIT said that the unrealised portion was derived from changes in fair value of AEON Mall Kinta City, as well as six other KIPMalls in Tampoi, Kota Tinggi, and Masai in Johor; Senawang in Negeri Sembilan; Melaka; and Bangi in Selangor.

KIP REIT did a revaluation exercise on its portfolio of investment properties, consisting of the seven retail malls. According to the document, the company reported that AEON Mall Kinta City has a surplus value of RM33.5 million, with its fair value of RM254 million from its carrying value of RM220.5 million.

For the full financial year, KIP REIT’s net property income rose 0.2% to RM56.75 million, up from RM56.66 million in the past year. Its full year distribution per unit amounted to 6.8 sen.

“The slight decrease in revenue was mainly due to lower revenue recorded in Bangi upon anchor tenant lot vacated since end Feb 2022, in preparation for the new anchor tenant onboarding in July 2022, but cushioned by lower rental rebate amortisation and higher promotional area income with further relaxation of the standard operating procedures.

“The net property income came in lower, in tandem with lower revenue at a higher negative variance as compared to preceding year's corresponding quarter, due to higher utilities and other property expenses with full force operating during quarter,” it said.

Moving forward, KIP REIT will continue to work closely with tenants and stakeholders to navigate the post endemic phase, to strike an appropriate balance between rental rates and occupancy rates, alongside practising fiscal prudence.

It will also continue to evaluate growth opportunities in its existing and new asset classes of retail and commercial and industrial assets, it said.

On Thursday (July 28), KIP REIT’s share price was unchanged at 90.5 sen, valuing the group at RM457 million.

TOP PICKS BY EDGEPROP

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

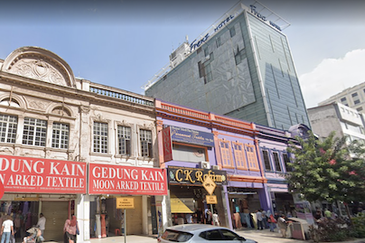

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur