PETALING JAYA (Apr 28): An influx of prime high-rise residential properties is expected in 2022, adding further pressure on capital values, according to JLL Property Services (M) Sdn Bhd as reported by The Sun Daily on Apr 27.

The daily quoted researcher and consultant Eva Soo, who during a webinar at the JLL Q1'22 Real Estate Market Perspective said that the incoming large supply is mainly due to delays in completion over the past two years due to the economic restrictions brought on by the pandemic.

She added that this will lead to an increase in unsold properties over the next few years before the market adjusts itself. However, the present all-time-low interest rate of 1.75% would encourage investors to return to the market.

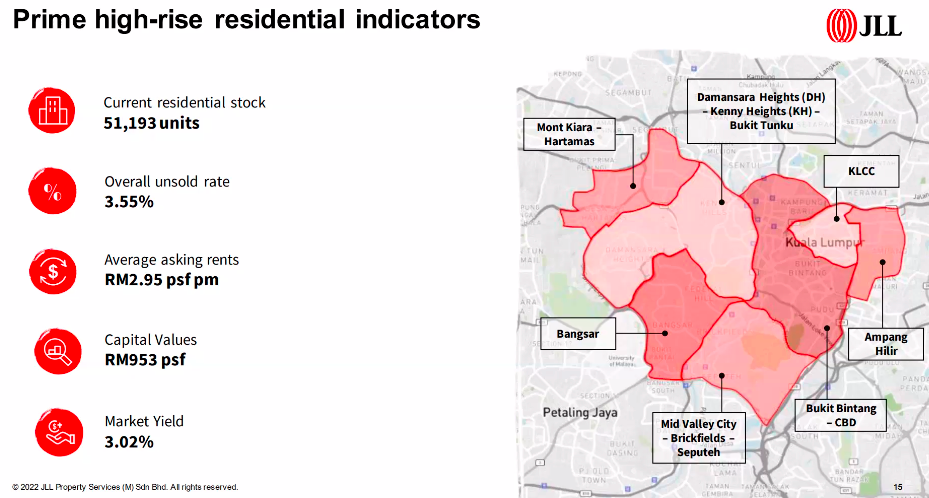

The capital value stood at RM953 psf as of Q1 2022, while the average asking rent at RM2.95 psf per month.

According to JLL Greater Kuala Lumpur property market monitor Q1’22 report, residential capital value growth declined 2.5% quarter-on-quarter (q-o-q) and average rent declined 2.3% q-o-q.

The market yield was at 3.02%, generally lower than other asset classes.

Prime high rise residential stock in Greater KL, covering KL City and extending towards Mont'Kiara, Damansara Heights, Bangsar, and Mid Valley was 51,000 units.

Additionally, the overall unsold rate is still considered quite healthy at 3.55%, said Soo.

Meanwhile, the ending of stimulus packages such as the Home Ownership Campaign and loan moratorium has led to a reduction in demand.

“The ending of the incentives has limit the demand for the residential market, but only for a very short term when talking about prime high rise residential,” said Soo, adding that the zerorisation of Real Property Gains Tax has encouraged many property owners to put their property on sale in the secondary market.

“As we see an increase in the primary market and at the same time, probably supply in the secondary market, capital values will likely compress quite a bit in this year," she noted.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates