KUALA LUMPUR (Feb 14): MEX 1 Capital Bhd has announced the completion of its restructuring exercise via the issuance of Islamic medium term notes (MTN) of up to RM1.13 billion in nominal value.

The sukuk is based on the shariah principle of Musharakah-rated A2 by RAM Ratings, said the Maju Holdings Sdn Bhd-owned highway concessionaire.

The financial adviser for the exercise is NewParadigm Capital Markets Sdn Bhd, with Alliance Investment Bank as the principal adviser, lead arranger and lead manager and Messrs Adnan, Sundra and Low as the legal adviser.

Besides the RM1.13 billion senior sukuk programme, MEX I has proposed a RM2.21 billion subordinated sukuk isssuance. The date of lodgement with the Securities Commission Malaysia for the RM1.13 billion sukuk and RM2.21 billion sukuk were Dec 31, 2021 and Jan 5, 2022 respectively.

MEX I received approval from its sukuk holders to restructure the RM1.35 billion programme at an extraordinary general meeting (EGM) on Oct 13, 2021.

According to reports, its managing director Mohd Faiq Abu Sahid said the resolutions from the EGM marked a new beginning for its group-wide sukuk restructuring.

MEX I is the parent company of Maju Expressway Sdn Bhd (MESB), and the holding company of both MEX I and MESB is Maju Holdings. The latter has businesses that include construction, property development and healthcare services.

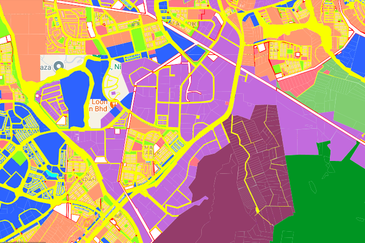

MESB operates the 26km Maju Expressway (MEX) in the Klang Valley as the highway concession company.

Edited by S Kanagaraju

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

HIJAYU 3A @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

RIMBUN IRAMA @S2 HEIGHTS

Seremban, Negeri Sembilan

Setia Warisan Tropika (Belladonna)

Sepang, Selangor

FREEHOLD Zoning Industrial Land For Sale | Kawasan Perindustrian Nilai 3 2 Pajam Arab Malaysian Industrial Park Nilai Utama Enterprise Park

Nilai, Negeri Sembilan