KUALA LUMPUR (Jan 21): Axis Real Estate Investment Trust's (Axis REIT) net property income rose 10.4% to RM53.77 million for the fourth quarter ended Dec 31, 2021 (4QFY21) from RM48.73 million a year earlier, mainly due to contributions from newly acquired properties and positive rental reversion.

The commercial property REIT, in a bourse filing, announced another distribution per unit (DPU) of 0.38 sen for the quarter. Coupled with the dividend that was declared on Dec 1, total DPU declared for the quarter was 2.41 sen, up 7.1% compared with 2.25 sen for 4QFY20.

This gives a total DPU of 9.49 sen for FY21, an increase of 8.5% compared with FY20’s 8.75 sen, and translates to a dividend yield of 4.9% based on the closing price of RM1.94 on Dec 31, 2021.

Axis REIT’s total trust income for the quarter stood at RM62.94 million, 9.44% higher than the RM57.51 million reported for 4QFY20.

For the full financial year, Axis REIT's net property income rose 9.4% to RM208.29 million from RM190.35 million in FY20, as total trust income increased 7.77% to RM242.41 million from RM224.94 million.

In a separate statement, Axis REIT Managers Bhd CEO and executive director, Leong Kit May, said the REIT had completed the acquisition of five properties worth a total of RM223.2 million, raising its total investment properties value to RM3.6 billion for FY21.

Axis REIT said its fund size also increased by 13.3% to 1.63 million units in FY21, from FY20’s 1.44 million units upon completion of its placement exercise on Dec 20, 2021 and implementation of the income distribution reinvestment plan.

The number of its unitholders, meanwhile, expanded by over 55% to 10,521, from 6,776 as at end FY20.

“Since our listing in 2005, our portfolio has grown from five properties to 58 properties with the total asset value rising about 10-fold to RM3.8 billion currently.

“Moving forward, we will continue to pursue high quality accretive acquisitions with strong recurring rental income by leveraging on our healthy gearing level of 31% to deliver sustainable earnings per unit and DPU payout to our unitholders,” said Leong.

Axis REIT units closed two sen or 1.1% higher at RM1.84, valuing the REIT at RM2.66 billion.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

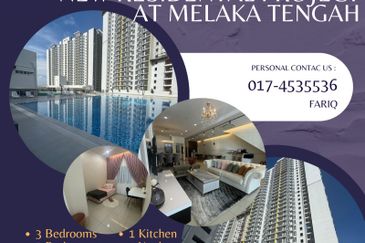

Sri Melaka Residensi, Bukit Serindit, Melaka Tengah, Melaka

Bukit Serindit, Melaka

8 Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Taman Perindustrian USJ 1

Subang Jaya, Selangor

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur