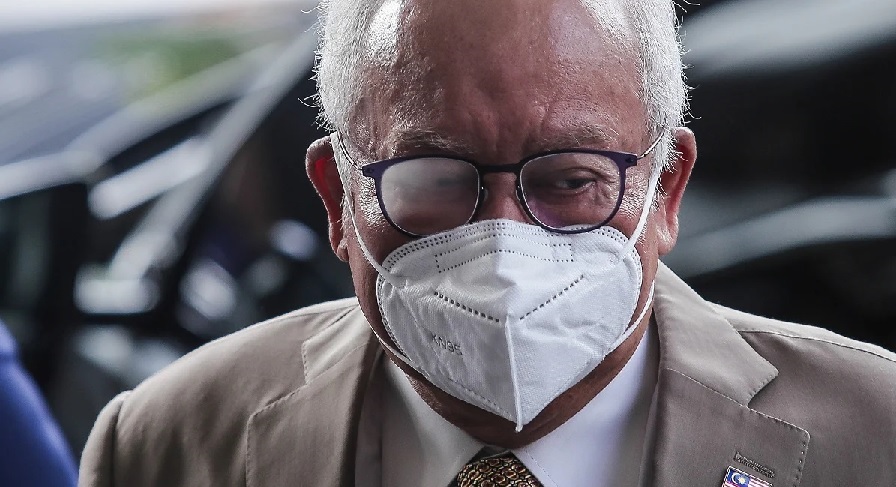

PUTRAJAYA (Oct 29): The Federal Court on Friday (Oct 29) fixed Feb 16 next year to hear the appeals of former premier Datuk Seri Najib Razak (pictured) and his son Datuk Nazifuddin Najib over the summary judgement entered against them over unpaid taxes of RM1.69 billion and RM37.64 million respectively.

The date was fixed by apex court deputy registrar Rasidah Roslee following case management held online.

Wee Yeong Kang from Messrs Shafee & Co said this to theedgemarkets.com when contacted on Friday, adding that further case management of the matter is fixed for Feb 8.

“The hearing for leave will be held via online through the Zoom application,” he said.

The Malaysian government through the Inland Revenue Board (IRB) was represented by Al Hummidallah Idrus and Siti Aisyah Yusoff, while Abhilaash Subramaniam is an amicus curiae from the Malaysian Bar.

The former premier and his son's notice of motion for leave to appeal followed the Court of Appeal's Sept 9 dismissal of their appeal over the summary judgement that was entered on them by upholding the High Court decision.

When civil cases approach the apex court, leave (or permission) has to be gained first to ensure that the appeal is not frivolous and vexatious and following that, the merits would be heard at another date.

Najib and his son posed nine questions of law in their intention to appeal.

They are:

- Whether Section 106(3) of the Income Tax Act 1967 contravenes Article 121 of the Federal Constitution;

- Whether Section 106(3) of the Income Tax Act 1967 is unconstitutional and/or ultra vires as it usurps the judicial power of this court guaranteed by Article 121 of the Federal Constitution;

- Whether, by reason of Sections 103 and 106(3) of the Income Tax Act 1967, this court is wholly prevented from considering whether or not there are triable issues and/or some other reasons warranting a trial (within the meaning of Order 14, Rule 1 and Order 14, Rule 3 of the Rules of Court 2012), before deciding whether or not to give judgement in favour of the plaintiff, despite the fundamental liberties, rights and powers enshrined in, inter alia, Articles 5, 8 and 121 of the Constitution.

- Whether Article 121 of the Federal Constitution, which guarantees the judicial power of this court, is relevant in the determination of civil recovery proceedings in tax matters (including in summary judgement proceedings therein);

- Whether Order 14, Rule 3 of the Rules of Court 2012, which provides that a summary judgement application may be dismissed if a defendant can show “some other reason” for a trial to be held, applies in civil recovery proceedings in tax matters;

- Whether in instances of manifest and obvious errors in calculation of a tax assessment, a court is entitled by virtue of its inherent and judicial powers to consider a defendant’s defence of merit to dismiss or set aside an application for summary judgement by a plaintiff and order a full trial on the matter;

- Whether the judicial power of the federation that is vested in the High Court, Court of Appeal and Federal Court may be suspended and/or abrogated in a tax recovery suit filed under Section 106(1) of the Income Tax Act 1967 on the basis of Section 106(3) of the same Act;

- Whether the judicial power of the federation vested in the High Court, the Court of Appeal and Federal Court may be suspended and/or abrogated in a tax recovery suit filed under Section 106(1) of the Income Tax Act 1967 on the grounds that an appeal to the Special Commissioner of Income Tax has been filed under Section 99 of the same Act: and

- Whether a defendant’s defence as to the plaintiff’s conduct of bad faith, mala fide, oppression, unconscionability, irresponsibility, unreasonableness and/or abuse of process falls within the scope of Section 106(3) of the Income Tax Act 1967, and whether the courts are entitled to consider such a defence as a triable issue and/or some other reasons warranting a trial in the context of civil recovery proceedings in tax matters (including in summary judgement proceedings therein).

It was reported earlier this month that both Najib and his son had obtained an interim stay of the appellate court decision as the IRB also filed a bankruptcy or insolvency hearing against them.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

Seri Mutiara Apartment, Bandar Baru Seri Alam

Masai, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor