KUALA LUMPUR (Oct 7): Country Heights Holdings Bhd has entered into five heads of agreements (HoAs) to acquire assets from its executive chairman and controlling shareholder Tan Sri Lee Kim Yew’s private investment holdings.

The acquisition of the assets worth a combined RM554 million is to be satisfied through the issuance of new Country Heights shares at an issue price of RM1.20 per share, the group said on Wednesday.

“I have decided to transfer some of the most attractive assets under my private holdings to Country Heights based on Covid-19 pandemic prices via issuance of Country Heights shares, in order to create immediate value in the group.

“This would also create a clearer line of separation between the listed entities and my private investments,” Lee, who has a direct stake of 28.55% and indirect stake of 37.11% in Country Heights, said in a statement.

The first HoA is between Country Heights (through its wholly-owned subsidiary Mines Holdings Sdn Bhd) and Country Heights Venture Sdn Bhd (CHHTSB) for the proposed acquisition of a 29.63% stake in Country Heights Health Tourism Sdn Bhd for RM6 million.

The group said GHHS Healthcare, the brand name for CHHTSB, will present an expansion plan for Country Heights’s wellness operations, as it has tremendous growth potential to expand their existing 30,000 memberships and wellness offerings into traditional Chinese medicine hospital, confinement centre, elderly day care and pharmacy.

Under the second HoA, Country Heights has proposed to acquire office units of the ninth and 10th floors of Block A of the Mines Waterfront Business Park @ The Mines Resort City with a total area of 22,500 square feet (0.52 acres), from Fresh Avenue Sdn Bhd, for an indicative purchase price of RM12 million. The proposed acquisition is for the group to consolidate all of the units in Mines Waterfront Business Park for future corporate exercise.

Under the third HoA, Country Heights proposes to buy a parcel of land in Ulu Langat — measuring 5.62 acres — from Bee Garden Holdings Sdn Bhd for RM42 million. It said the proposed land acquisition is for Country Heights to plan future developments that include mixed developments of residential, commercial, high-rise residential tower and waterfall landmark.

The fourth HoA involves the proposed acquisition by the group of a parcel of land in Kajang, measuring 2.82 acres, from Castlepark Sdn Bhd for RM21 million. This acquisition, it said, is for the group to plan future developments that include mixed developments of residential, commercial, high-rise residential tower and waterfall landmark.

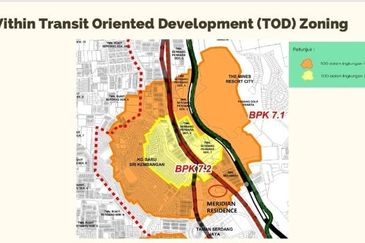

The group also proposed to acquire a parcel of waterfront development land in Petaling, measuring 37.98 acres, for a purchase consideration of RM400 million from Mines Wonderland Sdn Bhd. It said this acquisition is for the group to own the remaining jewel in the Mines Township and will be the anchor property for the planned transformation of the Mines Resort City.

Lastly, the group has proposed to buy a portion of a leasehold land in Petaling, measuring 4.325 acres of a total 7.244 acres from Mines Resort Sdn Bhd for RM73 million. This acquisition is for the development plan of service apartments under the name Phase Two of Dream City.

Shares in Country Heights closed unchanged at RM1.20 on Wednesday, for a market capitalisation of RM331 million.

Upon completion of the proposed acquisitions, Country Heights’ market capitalisation will be around RM1 billion, the group said.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

28 Residence @ Beverly Heights

KL City, Kuala Lumpur

LakeFront Residence Cyberjaya

Cyberjaya, Selangor

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Semenyih Integrated Industrial Park

Semenyih, Selangor

Taman Perindustrian Bukit Serdang

Seri Kembangan, Selangor

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan