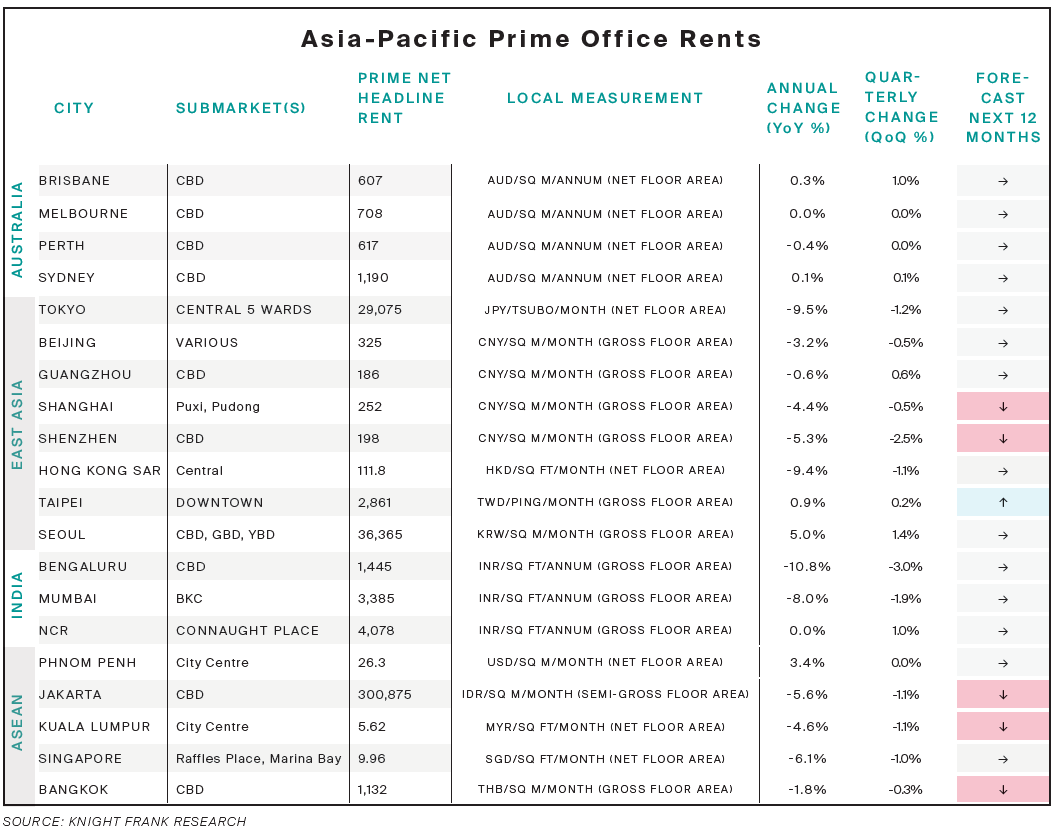

PETALING JAYA (July 14): Asia-Pacific prime office rental has dropped 0.8% quarter-on-quarter (q-o-q) and 4.7% year-on-year (y-o-y) in the second quarter of 2021 mainly due to the direct impact of resurgence of Covid-19 infections in most of Asia, according to Knight Frank’s “The Asia-Pacific Prime Office Rental Index” report.

The recent release report showed that the Asia-Pacific prime office markets lost much of their recovery gains generated in 1Q2021 as many countries were caught by a resurgence of infections, which is mainly caused by the Delta variant.

The real estate consulting firm pointed out that the sudden surge of infections led to many countries dialing back their re-opening and re-tightening their movement restrictions, which has set back operating conditions for the office market, further hampering what could have been the potential normalisation of the market conditions later this year.

“Despite the ongoing challenges, there was cautious optimism for the office markets across the region as markets gradually returned to normal and the recovery was built upon Q1’s momentum. Unfortunately, the situation has been mostly reset with recent outbreaks of the Delta variant and many markets within the region reverting back to some forms of lockdown,” said Tim Armstrong, Knight Frank Asia Pacific head of occupier services and commercial agency.

The 0.8% q-o-q fall was led by Bengaluru in India and Shenzhen in China, which recorded rental declines of 3% and 2.55% respectively. On an annual basis, the overall index was down 4.7% y-o-y.

“Going forward, we continue to expect office market conditions to remain lacklustre for the rest of the year, with some upside that the rate of rental decline could decelerate towards the year end, supported by vaccinations reaching a population majority. As such, we maintain our forecast for rents to decline at a slower pace for the full year compared to the 4.8% decline seen in 2020,” the report showed.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Taman Subang Indah PJS 10

Bandar Sunway, Selangor

Suasana Sentral Condominium

KL Sentral, Kuala Lumpur

Taman Teknologi Tinggi Subang

Shah Alam, Selangor

Subang Hi-tech Industrial Park

Subang Jaya, Selangor