PETALING JAYA (March 1): LBS Bina Group Bhd has appointed managing director Tan Sri Lim Hock San to succeed Datuk Seri Lim Bock Seng as the group’s executive chairman, effective today.

In a media statement today, LBS also announced that executive director Datuk Wira Lim Hock Guan will step up as the new managing director, starting today.

Lim Bock Seng, aged 90, has served as chairman of LBS since Dec, 2001. He had been involved with LBS for over 40 years prior to this where the business initially revolved around the transportation activities, primarily supplying and transporting building materials like sand and aggregates for construction and infrastructure works, before venturing into the construction sector and building up LBS.

“It has been my greatest privilege to serve as the Chairman for two decades. I want to show my deepest appreciation to all the talented and dedicated colleagues in LBS whom I have worked with over the years where some have been with the LBS family long before LBS was listed.

Together we have been through the numerous peaks and troughs of the business cycles, particularly the Asian Financial Crisis just before we were listed,” said Bock Seng in the statement.

Both Hock San, 63, and Hock Guan, 59, are Bock Seng’s sons.

Appointed as the group managing director since 2001, Hock San has spearheaded LBS and transformed the group into a household brand name as one of the leading players in the property development industry as well as venturing into the insurance and tourism businesses.

Meanwhile, Hock Guan was appointed as executive director of LBS in 2001. He holds a degree in Civil Engineering from the Tennessee Technology University, USA.

He also sits on the board of several subsidiaries of the group including MGB Bhd.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

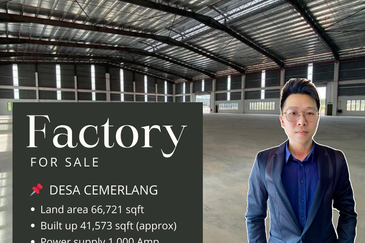

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Kawasan Perindustrian Tampoi

Johor Bahru, Johor

Nusa Cemerlang Industrial Park

Gelang Patah, Johor

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor