In a recent JLL survey, 66% of millennials in Asia Pacific, more than other age groups, said they missed the office and highlighted the office experience’s benefits: human interactions, professional environment, and place for focused work.

“JLL believes that the office is here to stay, but its format and functions may change significantly.

Read also

Re-planning office space under the new norm

New X factors in office requirements

Rising awareness on healthier workplaces

“Globally, office demand is predicted to remain broadly consistent with pre-pandemic levels over the longer term. JLL predicts that Malaysia will follow the global trend as an increase in remote working does not directly mean a reduction in office demand. Key factors include new approaches to office use and design,” Lau points out.

She explains that the office outlook is closely tied to the economic growth of the country, particularly the growth in the service sector.

“Looking forward, we believe that companies need to look in detail at how they use their offices, using technology to understand how they are utilising the office and then adapt accordingly. We are already seeing both Malaysian and multi-national companies doing these studies known as ‘workplace studies’,” she says.

Lau also reiterates that offices or workplaces will always be needed for interaction, engagement, collaboration and face-to-face communication. Staff may also prefer the office environment as their homes may not be ideal workplaces.

Demand going strong

Lau opines that the market has remained active in 2020, despite challenging market conditions.

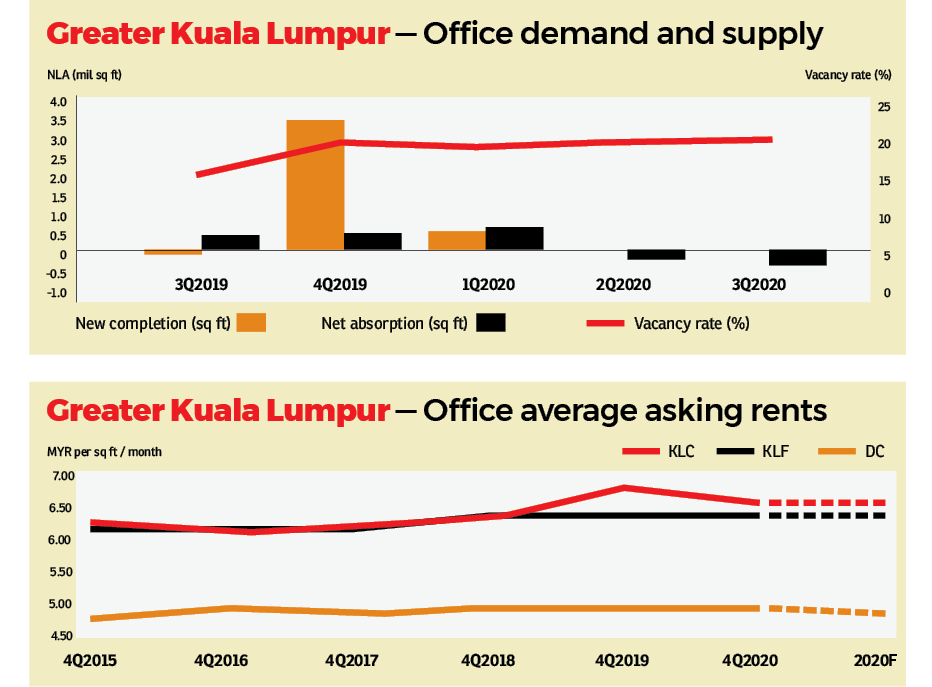

“Demand has been subdued in 1H2020 as we navigate the movement restrictions and work-from-home requirements. Currently, Kuala Lumpur Fringe has the highest occupancy rate of 92% as at 3Q2020. JLL believes that this submarket will continue to remain resilient in the medium term,” she notes

Meanwhile, the occupancy rate in the decentralised submarket is at 82.3%, while KL City’s occupancy stands at 73.5%.

“Average asking rents in KL City from our grade A basket remained the highest at RM6.59 psf per month, while KL Fringe is gradually catching up at RM6.34 psf per month. Average asking rent in Decentralised submarket Grade A basket stands at RM4.96 psf per month.

“Due to various factors such as economic slowdown, Covid-19 prevention and mitigation plans, and increasing trade barriers among major economies, demand is soft in KL City as its major tenants, such as the oil and gas as well as banking and finance sectors, have reduced their footprints.

“However, demand coming from technology and BPOs (business process outsourcings) remains resilient in KL Fringe and the Decentralised area, while new industries such as e-commerce have been expanding in KL Fringe,” Lau shares.

Upcoming office designs

More open-air common spaces

Focus on natural ventilation

Energy-efficient building design

Revisit the design of centralised air-conditioning system

Flexible office space to size up or down

Fewer number of doorways for better security and access control

This story first appeared in the EdgeProp.my e-weekly on Jan 29, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Putra Indah @ Putra Heights

Subang Jaya, Selangor

The Sky Residence @ Shamelin

Cheras, Kuala Lumpur

Pangsapuri Kasuarina

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor