With the increase of stratified properties in the country, there is no lack of information and discussions on it – ranging from the dos and don’ts, the upside and downside, the cost to even how to resolve differences among the residents.

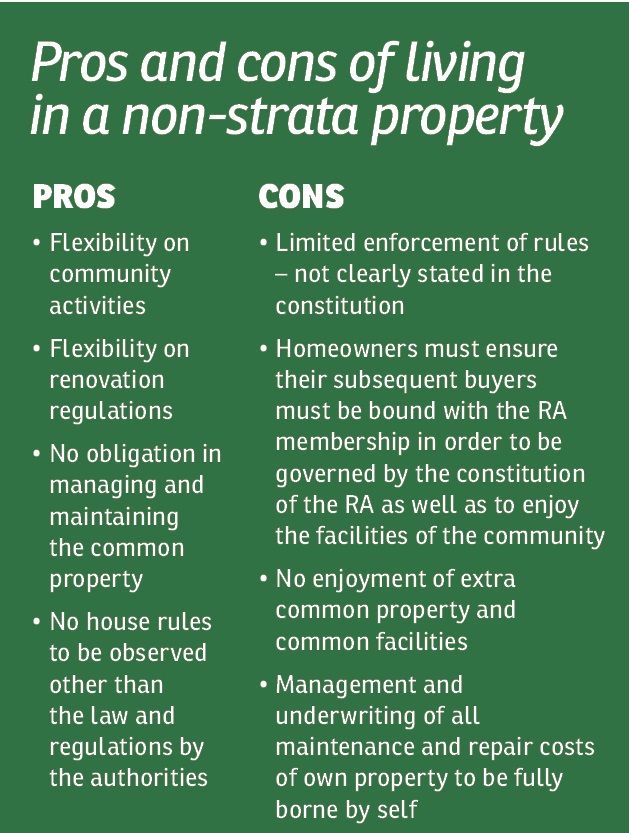

In contrast, non-stratified living is not usually under the spotlight, giving the impression it is more hassle-free. But do you know there are restrictions to living in non-stratified properties too?

Read also

Outstanding non-strata properties

Here, we debunk the myth that living in non-stratified properties means you can do “whatever you want”.

Difference between stratified and non-stratified properties

According to Chur Associates founder and managing partner Chris Tan, non-stratified properties are developed in a format not governed by the Strata Title Act 2013 (STA 2013) and the Strata Management Act 2013 (SMA 2013).

Typically, these properties have separate titles that accord the ownerships of the land plots and the buildings erected upon them to individuals who buy them.

“There is no common property to be enjoyed and maintained through the mandatory collection of service charges and sinking fund regulated by the said Acts. In addition to the differences identified above, the key difference is in the statutory obligations for strata property owners to participate in the management of the common property in a strata development,” Tan tells EdgeProp.my.

Freedom for all?

Since these properties are not governed by the Acts, does this mean the homeowners are free to do anything they like? Well, the answer is a big no.

Chur Associates’ Tan says the ownership of non-strata properties is predominantly regulated under the National Land Code 1965 and the common law. This means that the enjoyment of the property is also subject to the regulations of the local and state authorities.

Henry Butcher (Mont Kiara) executive director Low Hon Keong says that for non-stratified properties, there are various stakeholders and their respective laws include:

• Trust corporation: Trust Companies Act 1949 (revised 1973);

• Property management company: The Companies Act 2016 (Act 777);

• Residents’ association: The Societies Act, 1966 (Act 335).

Different stakeholders are also governed by their own respective statutory bodies and associations such as the Residents’ Association (RA), Registrar of Companies (ROC) and Registrar of Societies (ROS).

“Usually, these statutory bodies engage with local authorities beforehand [such as Kuala Lumpur City Hall], in order to have consent agreements that will legally recognise the non-stratified properties as gated-and-guarded communities and its constitutions,” says Low.

One of the biggest misconceptions Low has encountered is that some homebuyers of non-stratified properties think they have ultimate control and authority to modify their own properties.

Although their properties are based on individual land titles, it is important to note that homeowners cannot simply modify their own properties as there are certain rules under their RAs’ constitutions that they must comply to as residents.

“Furthermore, these constitutions are usually enforced by the RA in respect of the following – to maintain uniformity within the development, to preserve the original concept as well as overall sentiment of the community and to ensure safety features are not compromised,” Low highlights.

Myth no. 1: No cost of maintaining common facilities

Low adds that for stratified homeowners, the payment to upkeep the property and its surroundings is usually termed as “service charges” whereas for non-stratified homeowners, it is commonly called “maintenance fees”.

Nonetheless, both of these terms refer to the owners’ monthly commitment which they pay in order to maintain their facilities, security and other aspects of their properties.

“It is common knowledge that for stratified properties, the service charges are usually calculated using share units which are based on the size of their parcels and accessory parcels. However, for non-stratified properties, there is no share unit involved as such calculations are usually based on the property type within the development,” says Low.

He cites an example where for a community with semidee and bungalow units, the bungalow units will be charged higher fees due to the larger portions of land which the properties sit on.

“It is very important to note that the major expenditure for the maintenance fees are usually for security expenses as security companies play important roles in protecting the enclave of gated-and-guarded communities. Additionally, most homebuyers place security and safety as one of their highest priorities when it comes to choosing properties,” Low points out.

Myth no. 2: No need to pay maintenance fees?

Meanwhile, Chur Associate’s Tan says that one of the biggest misconceptions for non-strata property homebuyers and investors is that there is no need to pay monthly service charges and contributions to the sinking fund for their properties.

“However, payments of quit rent and assessment to the authorities are a form of maintenance charges too for the services provided.

“Nevertheless, the increased popularity of gated-and-guarded community living could actually be because non-strata properties’ obligations (including payments and contributions) are regulated by way of contract rather than under a specific law like the SMA 2013,” says Tan.

The Malaysian Institute of Property and Facility Managers (MIPFM) president Adzman Shah concurs with Tan, observing that these homebuyers would also assume that no maintenance charge is to be paid since the local council should be taking care of the common areas i.e. roads, drains, hard and soft landscaping, street lights, etc.

“They, however, forget that the provision of security service, maintenance of power fencing (if any), CCTV system, the management office operations, maintenance and repair, boom gate and access card system, visitor management system, and power and water supply for the guardhouse cost money and therefore involve collection of funds from the owners,” he adds.

Myth no. 3: There’s no governing laws

Unlike strata properties, the RAs and property management companies do not have the SMA 2013 and Strata Tribunal Court to refer or go to should disputes arise. How then, should one tackle any dispute which arises from the community?

Tan says that RAs are subject to the regulations of the ROS, a separate legal regime that has a high governance level.

“Disputes can be referred to the ROS or even the civil courts. In addition, property management is a regulated profession under the The Board of Valuers, Appraisers, Estate Agents and Property Managers (BOVAEP). Hence, the conduct of the property management companies is a valid subject of complaint to the Board. For any contractual disputes, you can always file a claim in the civil courts,” Tan explains.

Meanwhile, MIPFM’s Adzman raises an important point for consideration – RAs should engage experienced property management companies to manage such schemes so that when disputes arise, it will be easier to resolve the issues.

“The personnel need to have good public relation skills and some legal understanding on how to enforce house rules and handle collection of maintenance charges. It is also important to get proper legal advice in relation to undertaking the responsibilities in managing and maintaining the scheme,” says Adzman.

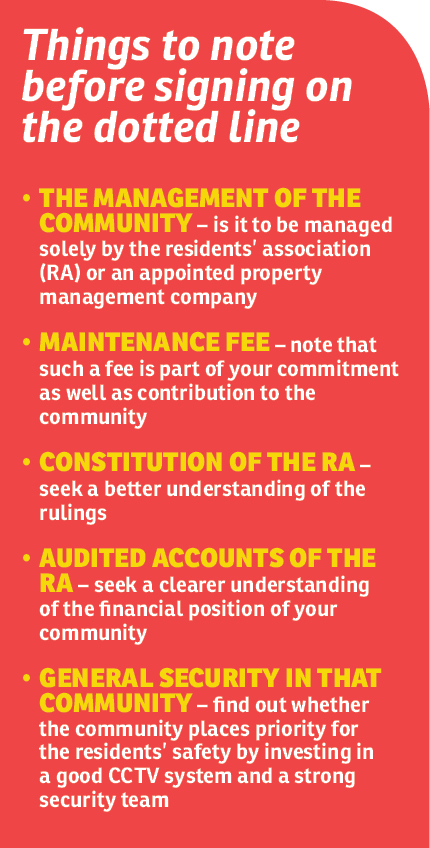

Before you sign on the dotted line

Pretty much made up your mind on buying a non-strata landed property?

Henry Butcher’s Low notes that it would be good for homebuyers to further study and have a clear understanding of what it takes to stay in a non-stratified community. “This is to ensure they share the same value and sentiment in that neighbourhood,” says Low.

On this, Low has listed down five things that homebuyers should take note of.

Every man must not be for himself

Safety and security are top concerns for most homeowners in these times due to rising crime rates, stresses Henry Butcher’s Low.

“Looking at our current situation in the Klang Valley and other states, I believe it is really important for homeowners to be supportive and give full cooperation towards their respective RAs when it comes to complying to rules and regulations of the community in order to nurture community living spirit,” he states.

Some owners may ignore the rules and regulations. Such an attitude would greatly jeopardise the community in the long run, especially when it comes to enforcing a ruling that involves security and safety.

When there is no proper enforcement by the RA as well as lack of compliance amongst residents, it will be a ticking time bomb before there is a breach of security within the community.

“I understand that it can be an inconvenience at times but it is really crucial for all residents to be responsible and compliant to the regulations in order to ensure safety for all residents as well as uplifting the community spirit,” Low stresses.

Meanwhile, MIPFM’s Adzman emphasises that RAs should work closely with the developer to ensure all the necessary conditions have been incorporated in the Deed of Mutual Covenant from the start.

“Developers who sell such concepts should also be aware of the need to prepare the right documentation and infrastructure so that the handing over to the RA can be done properly,” he says.

Chur Associate’s Tan highlights that community living today has become very sophisticated to address the different lifestyles in integrating commercial and non-commercial activities and it can be done in strata and non-strata formats.

“Buyers and investors must know clearly what they are buying themselves into to set and manage their expectations accordingly,” he concludes.

This story first appeared in the EdgeProp.my e-Pub on Nov 27, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my

TOP PICKS BY EDGEPROP

Taman Sri Hijau ( New Green Park )

Rawang, Selangor

Temasya Glenmarie (Commercial)

Shah Alam, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Country Heights Damansara

Country Heights Damansara, Kuala Lumpur

Alam Perdana Industrial Park

Puchong, Selangor