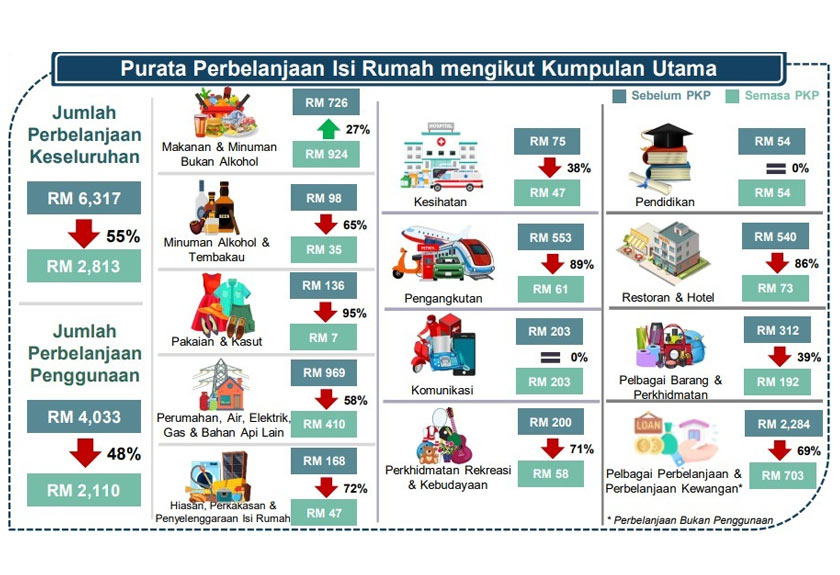

KUALA LUMPUR (April 8): The Movement Control Order (MCO) to combat the COVID-19 outbreak has impacted the country’s household spending patterns, recording a decrease of RM3,504 or 55%, reported The Malaysian Reserve (TMR) based on figures by the Department of Statistics Malaysia (DoSM).

The department also revealed that “average spending on consumption is estimated to decrease by RM1,923 or 48%”.

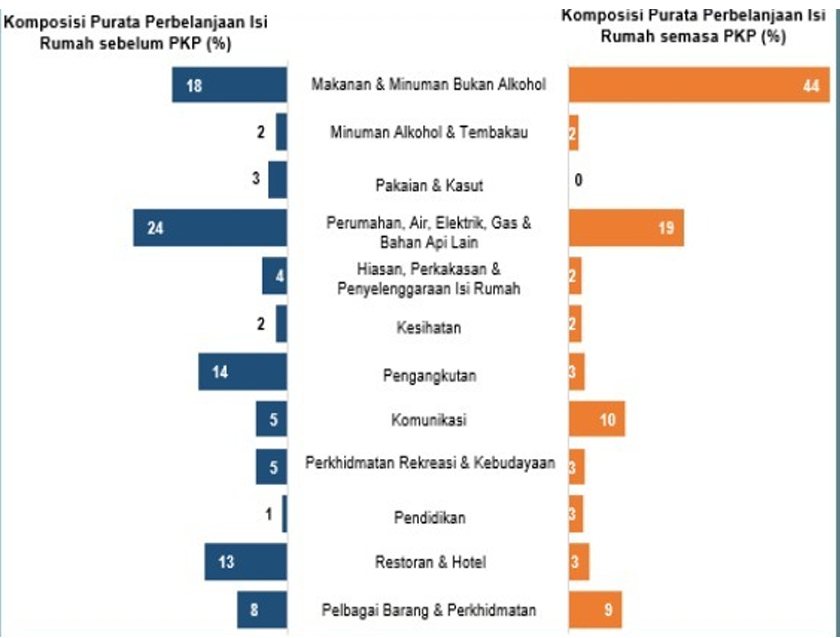

The report stated that during the MCO period, there is more spending on essential goods and services such as food, utilities, health and communication.

“Purchases of food and non-alcoholic beverages increased by 27% as a result of the need to purchase raw materials for home consumption,” wrote the TMR based on DoSM statistics.

Expenditure on education and communication is also deemed important with online learning services now being the rage with school and higher learning institutions shuttered.

Purchase of communication services have also gone up Malaysians and those stuck in Malaysia rely “on online communications to stay in touch with the outside world” and also for work.

TMR also reported that there was a “95% drop in clothing and footwear purchases”, while spending on transportation fell by 89%.

Other items and services that are being avoid by consumers are restaurants and hotels with an 86% drop; household decoration, hardware and maintenance (72%); recreational and cultural services (71%); and alcoholic beverages and tobacco (65%).

Meanwhile, food and non-alcoholic beverages “dominated average spending by 44% compared to just 18% before the MCO” with more people eating and drinking at home during the MCO.

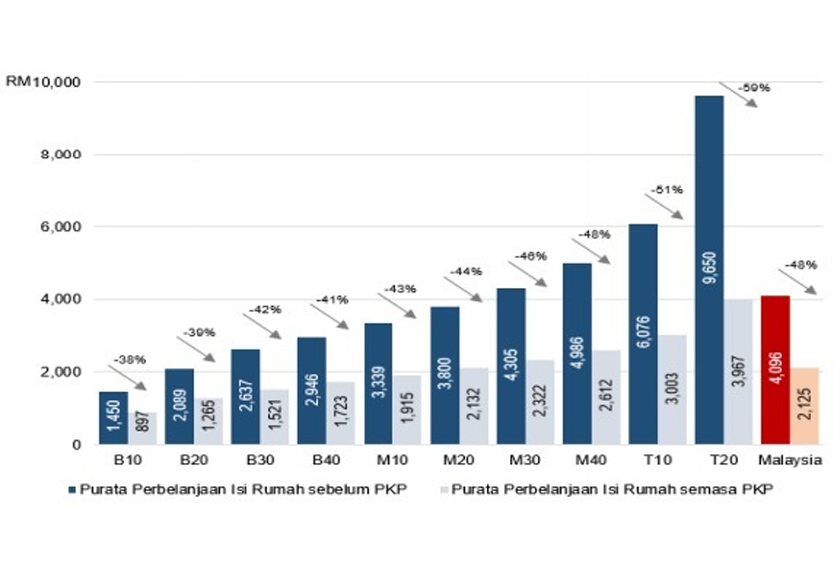

As for household spending based on income class, TMR wrote that DoSM “research showed a significant drop in consumption expenditure (59%) among the Top 20 income group (T20), followed by the M40 group (48%) and B40 (41%)”.

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

TOP PICKS BY EDGEPROP

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Taman Perindustrian Bukit Serdang

Seri Kembangan, Selangor

Kawasan Perindustrian Nilai

Nilai, Negeri Sembilan

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Section 19 (Seksyen 19) @ Shah Alam

Shah Alam, Selangor