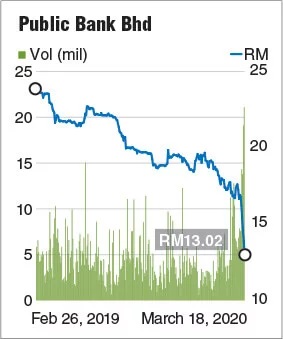

KUALA LUMPUR (March 19): Public Bank Bhd, usually described as solid like a rock, suffered its largest single-day percentage drop in ten years, to close at RM13.02 yesterday — its lowest level since August, 2013.

The banking stock shed 88 sen or 6.33%, giving it a market capitalisation of RM50.55 billion. It was the top loser among all the listed banks on Bursa Malaysia yesterday, followed by CIMB Group Holdings Bhd (down 4.01%), RHB Bank Bhd (down 2.99%), Malayan Banking Bhd (Maybank, down 1.36%) and Hong Leong Bank Bhd (down 1.27%). Compared against its all-time high, the counter has plunged 45% since its highest closing of RM23.85 on Jan 22, 2019.

Trading volume jumped to 21.11 million shares — the highest level since May 2018. The volume has been high in the past few days rising above 10 million since last Friday, compared with its 200-day average volume of 4.44 million.

The six consecutive days of drop has wiped off RM16.62 billion market capitalisation from Public Bank. Some RM24.9 billion market capitalisation has evaporated since the start of the year.

Public Bank is not the only one bashed down by the global equity rout. The fierce selling was due partly to its high foreign shareholding which was at about 30% last month.

Furthermore, banking stocks have come under selling pressure given their cyclical nature that is highly sensitive to the economic weather. The current harsh economic conditions raise concerns on banks’ earnings prospects and asset quality.

Year to date (YTD), Public Bank has dropped 33% since its closing of RM19.44 on Dec 31, 2019, the third-largest fall among the local listed banks after Alliance Bank Malaysia Bhd, which slid 38.8% YTD, and CIMB Group Holdings, which dipped 34.95%.

Despite the downtrend, Public Bank is still trading at 1.16 times its price-book value, while most of its local and regional peers, such as Hong Kong-listed HSBC Holdings plc, Singapore-listed DBS Group Holdings Ltd, have seen the ratio fall below one.

The sharp fall in its share price drove up its dividend yield to 5.6% from below 3% previously.

In a strategy note dated March 16, Affin Hwang Capital Research had downgraded its call on Public Bank to “sell” with a lower target price of RM13.85 versus RM18 previously.

The research house also downgraded all the other banks under its coverage to “sell”, and recommended its clients to underweight the banking sector.

However, Bloomberg data showed that there are still seven “buy” calls on the Public Bank, versus four “sell” calls and 11 “hold” calls.

Analysts’ target prices on Public Bank ranged between RM13.85 and RM22.60, averaging at RM18.80.

Hong Leong Investment Bank (HLIB) Research, which has a “neutral” call on the banking sector, estimated that for every 0.1% of loans turning bad, net credit cost (NCC) could rise by 10 basis points (bps) and reduce sector earnings by 5%.

It noted that NCC rose 2bps to 127bps during the severe acute respiratory syndrome epidemic in 2003, while the oil crisis between 2014 and 2016 resulted in a 10bps jump in NCC to 24bps.

However, the research house does not expect a drastic increase in NCC this time around, amid the more cohesive effort to rein in the impact of COVID-19, in the form of financial relief by banks to their borrowers affected by the pandemic.

Moreover, oil and gas (O&G) companies are expected to have stronger balance sheets than those during the 2014-2016 oil crisis.

Banks have also reduced their O&G loan exposure over the past three years, said HLIB.

Click here to see commercial properties for sale in Kuala Lumpur.

This article first appeared in The Edge Financial Daily, on March 19, 2020.

TOP PICKS BY EDGEPROP

Jalan Setia Nusantara U13/22N

Setia Eco-Park, Selangor

Setia City Residences @ Setia City

Setia Alam/Alam Nusantara, Selangor

Tiara Mutiara 2

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

PJ Transit Oriented Office Building For Sale - Ideal For Corporate Office Headquarters

Petaling Jaya, Selangor

Tropicana Aman 1

Telok Panglima Garang, Selangor