KUALA LUMPUR (Jan 16): The construction industry saw a recovery in sentiment in 2019, amid news of the government’s intention to revive several mega infrastructure projects that were put on hold or postponed after the government change in 2018.

The Bursa Malaysia Construction Index reflected the optimism on recovery, rising from 155.79 points at the start of the year to a high of 227.46 on July 3, before floating above the 200 mark towards the end of 2019, indicating that the market has already priced in the upcoming contracts.

The index’s 34% advance in 2019 compared with a 6% decline in the benchmark FBM KLCI during the year

Last year, the government announced the revival of several infrastructure projects including the East Coast Rail Link (ECRL), Bandar Malaysia as well as the Kuala Lumpur-Singapore high-speed rail (HSR) projects.

Announcements aside, however, contract awards slowed down in the second half of the year, dragging down the total value of contracts awarded for the first 11 months of 2019 to RM10.7 billion, 17% lower than the RM12.9 billion recorded in the same period a year earlier, said Public Investment Bank.

The research house expects awards to pick up in 2020, given the mildly expansionary Budget 2020 announcement, which includes a RM56 billion allocation for development expenditure.

However, it maintained “neutral” on the sector as the positives have already been priced in by the market.

“The new big ticket projects that will take place are the ECRL with subcontracts worth RM17.6 billion (40% of total project value of RM44 billion) and Johor Baru-Singapore Rapid Transit System valued at approximately RM4 billion,” it said.

In the second half of the year, the research house expects the phase 1 award for the Penang Transport Master Plan project, comprising the RM8.5 billion Bayan Lepas Light Rail Transit (LRT) and the RM7.5 billion Pan Island Link 1 (PIL1).

It added that the earnings outlook of construction companies will start to stabilise in 2020, amid healthy order books with visibility of at least two years, coupled with the continuous efforts of companies to contain costs.

Hong Leong Investment Bank (HLIB) said jobs in Sarawak are picking up the slack, while Peninsular Malaysia job flows remained tepid in 2019.

“We expect stronger job flows as the state government has allocated RM9.9 billion for development expenditure under the State Budget 2020, beating its previous high of RM9 billion in 2019,” said the research house.

Sarawak’s upcoming contracts include the remaining four bridge contracts worth RM1.8 billion from the RM6 billion Coastal Road project, 11 sub-packages of the RM5 billion Second Trunk Road project, as well as the first work package of the Sabah-Sarawak Link Road worth RM1.2 billion.

Meanwhile, the implementation of water-related projects and wastewater management worth RM2.8 billion have also been ongoing since 2018.

The first half of 2020 is expected to be dominated by news relating to the ECRL, Pan Borneo Highway Sabah and some packages for the Central Spine Road project, said HLIB, while the Bayan Lepas LRT project is expected to be rolled out in the second half of the year, along with smaller projects like the RTS and Iskandar Bus Rapid Transit.

“In our view, projects like PIL1 (RM7.5 billion), MRT3 (Mass Rapid Transit 3) (RM22 billion) and HSR (RM60 billion) will likely be delayed to be included under the 12th Malaysia Plan due to insufficient funding from the bond issuance for PIL1, unlikeliness of MRT3 to gain traction prior to completion of MRT2 and possible extensions to the current deadline of HSR considering repeated delays so far for the less complex RTS,” said HLIB.

While order books remain healthy, TA Securities analyst Ooi Beng Hooi expects total contracts to dwindle as the award of mega infrastructure projects will only happen towards the end of the year.

“More news flow about the tender for the ECRL may surface only in the middle or late 2020, while the roll-out of MRT3 and HSR is not yet in sight.

“Furthermore, there are some hiccups in the implementation of ongoing mega infrastructure projects such as Pan Borneo [Highway] Sarawak, LRT3 and West Coast Expressway, which resulted in the progress of the said projects moving at a less-than-desirable pace,” said Ooi, who maintained an “underweight” call on the construction sector.

In terms of top picks for the sector, Public Investment Bank prefers Gamuda Bhd, IJM Corp Bhd and Hock Seng Lee Bhd (HSL).

HLIB picked HSL on account of the counter acting as a proxy to the Sarawak construction upcycle. Another of its top pick is Sunway Construction Group Bhd due to its strong balance sheet, positive earnings trajectory and strong support from its parent company Sunway Bhd.

Meanwhile, TA Securities prefers GDB Holdings Bhd and Pesona Metro Holdings Bhd as they are said to possess strong execution capabilities with proven track records as well as strong earnings visibility.

This article first appeared in The Edge Financial Daily, on Jan 16, 2020.

TOP PICKS BY EDGEPROP

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Regent Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Nusa Cemerlang Industrial Park

Gelang Patah, Johor

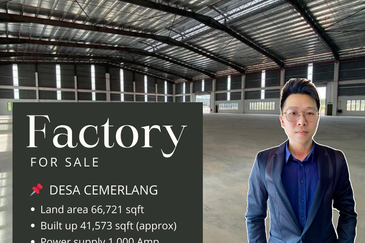

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor