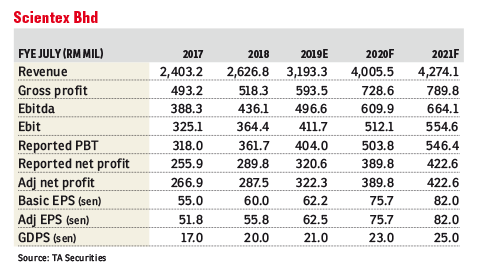

Scientex Bhd (June 11, RM8.54)

Maintain buy with an unchanged target price (TP) of RM9.80: Yesterday, Scientex Bhd announced its proposed acquisition of six parcels of freehold land in Seberang Perai Utara, Penang, measuring 180 acres (72.84ha) for a total cash consideration of RM109.6 million or RM14 per sq ft. We are positive about the long-term prospects as this would provide Scientex the opportunity to strike on northern Malaysia, thus expanding the group’s property footprints. We did not change our earnings forecasts.

The proposed acquisition of the parcels is strategically located in Tasek Gelugor, within the Seberang Perai Utara district. The town, adjacent to Taman Sepadu, is easily accessible from Butterworth, Kepala Batas and Padang Serai. Further, the parcels are near the Tasek Gelugor Keretapi Tanah Melayu (KTM) station, with accessibility to the North-South Expressway at approximately 9km in distance.

Scientex plans to leverage the new parcels to establish its market presence in Penang, particularly in the affordable landed property segment. The proposed acquisition of the parcels is expected to be completed by the first half of calendar year 2020. Given the acquisition is still at a preliminary stage, no gross development value (GDV) guidance is available.

However, we have conservatively estimated the potential GDV to be RM1 billion, based on an average of RM5.5 million GDV per acre of the surrounding projects. Based on a recent precedent transaction by Tambun Indah Land, we understand the land cost of acquisition is RM14.35 per sq ft. Hence, we find Scientex’s acquisition price of RM14 per sq ft, a 2.4% discount, to be decent. Moreover, the land cost of RM109.6 million makes up about 10% of the potential GDV which is reasonable.

We did not change our earnings forecasts, pending more clarity from the management. Considering the aforementioned acquisition of the parcels and an earlier proposed acquisition in Rawang and Kundang in Selangor, announced on May 13, 2019, the financial year 2020 net gearing is projected to increase to 0.49 times from the current estimation of 0.4 times. We believe Scientex’s balance sheet will remain healthy after completing the land acquisitions. We maintained our “buy” call on Scientex with unchanged TP of RM9.80 per share based on sum-of-parts valuation. — TA Securities, June 11

This article first appeared in The Edge Financial Daily, on June 12, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

Gateway 16, Bandar Bukit Raja

Bandar Bukit Raja, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor