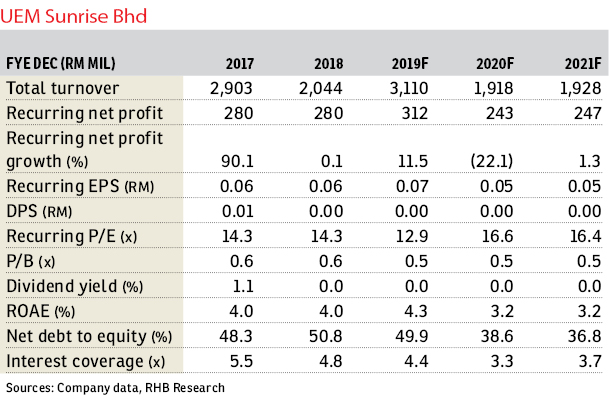

UEM Sunrise Bhd (April 22, 98 sen)

Upgrade to buy with a higher target price (TP) of RM1.14: After our recent meeting with UEM Sunrise Bhd chief financial officer Mohamed Rastam and investor relations and corporate planning Masleena Hafiza Mahdi, we felt positive about its well-planned Kepong project which, upon its launch in the fourth quarter of 2019 (4Q19), could surprise the market. With improving fundamentals — a successful de-gearing, the unwinding of unsold inventory, and the potential Kuala Lumpur-Singapore high-speed rail (HSR) angle — we are more bullish on the stock.

Recall UEM Sunrise boldly entered into a joint venture to develop a 73-acre (29.54ha) land in Kepong yielding a gross development value (GDV) of RM15 billion over 15 years. We understand that management is currently busy planning the Kepong project. We think the planning team has factored in Kepong’s population dominated by the Chinese. Hence, the commercial component and retail tenants would be carefully designed and selected. We expect the project to be well-received, given the company’s past success in Mont’Kiara, Kuala Lumpur.

Take note the Residensi Astrea has a 60% take-up since its launch in October last year, and the Solaris Parq is 75% sold despite its hefty pricing. We understand its first launch in Kepong would include two residential towers, with a GDV of about RM640 million. Recently, the company also acquired two three-acre parcels in Mont’Kiara. These should give an additional GDV of about RM600 million, enough to underpin its sales and earnings from the central region.

UEM Sunrise’s fundamentals have been improving, and we like management’s de-gearing and effort to reduce unsold inventory. Over the past one year, the company has been one of the more successful developers in unwinding stocks. Last year, it sold RM433 million worth of unsold units, and its outstanding unsold stocks stood at RM695 million as at financial year ended Dec 31, 2018 (FY18). Its net gearing, having eased to 0.51 times from 0.58 times as at 3Q18, is expected to fall further to less than 0.4 times after handing over its projects in Australia this year.

Apart from its stronger fundamentals, we think UEM Sunrise is a potential HSR play. We think the project could be revived given the Bandar Malaysia project’s recent reinstatement. UEM Sunrise has 4,550 acres — or a net of 2,300 acres — of freehold land in Gerbang Nusajaya, where the Iskandar Puteri mass rapid transit station would be located under the original plan.

Given the company’s better prospects, we raise the TP to RM1.14 from 86 sen previously, with a lower discount to revalued net asset valuation of 60% from 70%. — RHB Research Institute, April 22

This article first appeared in The Edge Financial Daily, on April 23, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Senna Residence Presint 12

Putrajaya, Putrajaya

Bandar Damai Perdana

Bandar Damai Perdana, Selangor

OUG Parklane

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur