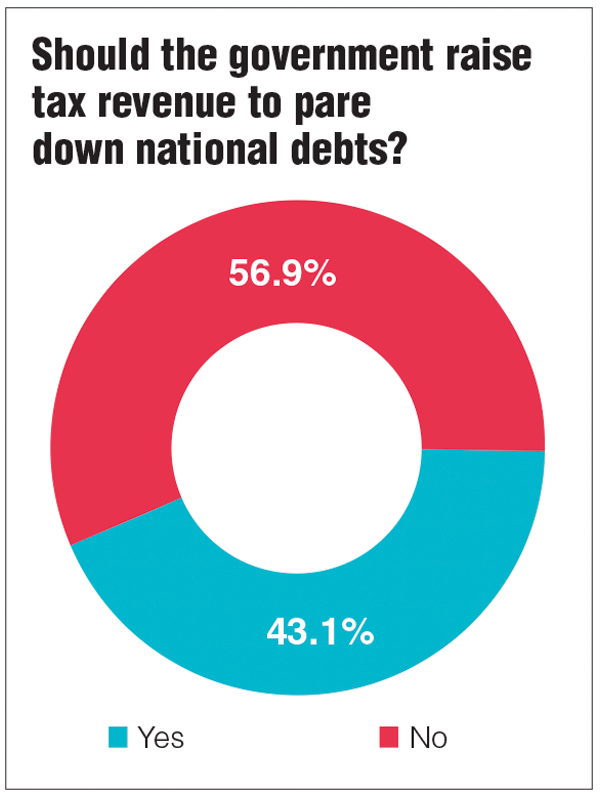

KUALA LUMPUR (Nov 1): Over half or 56.9% of respondents in an online survey conducted by The Edge ahead of the unveiling of Budget 2019 on Friday are of the opinion that the government should not raise tax revenue to pare down national debts.

Altogether 2,643 respondents took part in the survey with multiple-choice questions, which was conducted on theedgemarkets.com between Oct 16 and yesterday.

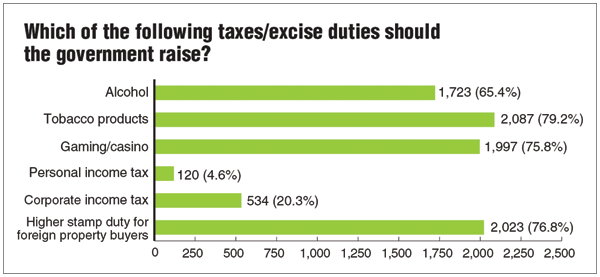

But given a choice on what tax the government should raise — and respondents could pick more than one — most respondents chose sin taxes, with tobacco products a hot favourite at 79.2%, followed by gaming/casino activities at 75.8%, and alcohol at 65.4%.

Going by their answers, it seems respondents are not sympathetic to the fact that the tobacco industry has been slapped with excise duty hikes for three consecutive years from 2013 to 2015 — at 14%, 12% and a whopping 40%, respectively. Tobacco players have also had to contend with the goods and services tax (GST) of 6% previously, before that was abolished and replaced with the 10% sales and service tax (SST) that was introduced this September.

Meanwhile, foreign property ownership is also seen as something that should be taxed more, with 76.8% choosing higher stamp duty for foreign property buyers.

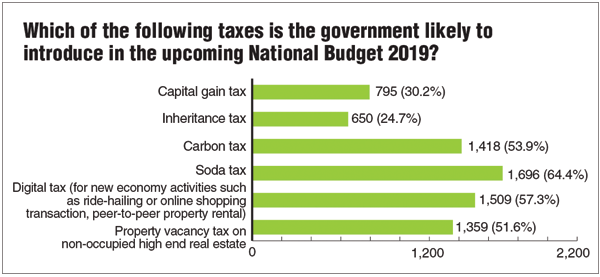

With speculation rife about new taxes to be introduced in the new budget, which is the first budget by the new Pakatan Harapan government, respondents were also asked about what taxes the government is likely to introduce.

The majority or 64.4% think soda tax will be introduced, followed by digital tax (defined as tax on new economic activities like ride-hailing or online shoping transactions and peer-to-peer property rental) at 57.3%, carbon tax at 53.9%, and property vacancy tax on non-occupied high-end real estate at 51.6%.

Trailing low on the list is capital gains tax at 30.2% and inheritance tax at 24.7%.

Most of the survey respondents are aged between 31 and 45 (43%), followed by those aged 18 to 30 (30.1%), 46 to 55 (14.1%), above 55 (12.2%), and below 18 (0.6%).

Respondents in the survey mainly come from those with an annual income of below RM60,000 (35.8%), followed by those earning from RM61,000 to RM120,000 per year (32.2%), from RM121,000 to RM200,000 (16.1%), and from RM201,000 to RM480,000 (10.9%). The remainder 5% are made up of those with annual incomes of RM481,000 to RM600,000, and above RM600,000.

This article first appeared in The Edge Financial Daily, on Nov 1, 2018.

TOP PICKS BY EDGEPROP

Kipark Apartment ( KIP Villa Indah )

Tampoi, Johor

D'Summit Residences @ Kempas Utama

Johor Bahru, Johor

Kampung Melayu Sungai Buloh

Sungai Buloh, Selangor

Taman Taming Indah 1

Bandar Sungai Long, Selangor

Almyra Residences @ Bandar Puteri Bangi

Bangi, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

City of Green Condominium

Seri Kembangan, Selangor