Property sector

Maintain market weight: The new housing policy is set to address house ownership issues whereby the government is expected to ease lending requirements and reduce cost of construction. The housing and local government ministry is set to focus on the property overhang issue which heightened further in the first half of 2018 (1H18).

The ministry has emphasised that it will address several issues. These include lowering house prices by reducing compliance cost and implementation of industrialised building systems. The federal government is also working closely with state governments on land issues, where the latter have been asked to submit a list of potential land plots that can be used for affordable housing projects.

Potential measures proposed for the new housing policy include the extension of a maximum loan tenure to up to 40 years and to provide various types of loan structures like flexi loans, flexi interest rates and step-up schemes. These “hybrid” measures provide better flexibility for homeowners to own houses, and allow young homebuyers to own a house once they join the workforce. At present, the maximum loan tenure is 35 years or until the borrower turns 70 years old, whichever is earlier.

Based on the valuation and property services department’s (JPPH) research, unsold and completed homes increased 18.1% to a new record high of 29,277 units in 1H18. JPPH said the majority of the overhang units are high-rise residences priced between RM500,000 and RM1 million. In view of this, we think property developers that focus on the affordable housing segment (RM500,000 and below) may continue to report decent earnings while developers that focus on the premium market may face risk of slower take-up rates and their margins could be compromised.

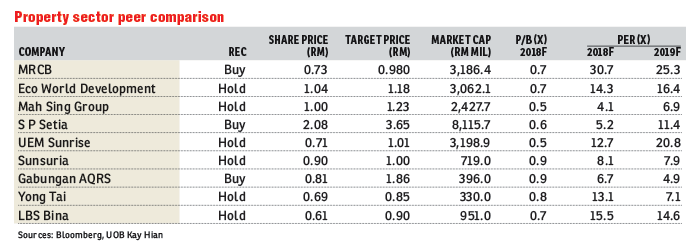

Maintain “market weight” on the sector. In the light of the slowdown in the sector, property stocks are trading below their long-term mean valuations. Most stocks are trading at well over 50% discounts to their assessed revalued net asset value.

Maintain “buy” on Malaysian Resources Corp Bhd (MRCB) (TP: 98 sen). MRCB’s ongoing transformation to strengthen its core businesses (property and construction) has resulted in positive improvements. On the other hand, the company continues to focus on divesting its non-core businesses such as the Eastern Dispersal Link (EDL) and Bukit Jalil land worth RM1.02 billion and RM1.1 billion respectively. These two proposed disposals would essentially improve MRCB’s overall balance sheet, reducing net gearing from 0.69 times to 0.45 times and 0.46 times respectively (assuming the disposal transactions occur separately). Meanwhile, MRCB is sitting on a strong order-book backlog of RM5.1 billion as of June 2018, which will provide earnings visibility in the next three to four years. Also, the company has only modest to moderate reliance on government infrastructure-related projects, which account for only 23% of MRCB’s external awarded contract value of RM6.2 billion. — UOB Kay Hian, Oct 17

This article first appeared in The Edge Financial Daily, on Oct 18, 2018.

TOP PICKS BY EDGEPROP

Seri Mutiara Apartment

Setia Alam/Alam Nusantara, Selangor

Jalan Setia Utama U13/37D, Alam Nusantara

Shah Alam, Selangor

SAUJANA TROPIKA @ S2 HEIGHTS

Seremban, Negeri Sembilan

Taman Yarl @ Old Klang Road

Jalan Klang Lama (Old Klang Road), Kuala Lumpur