KUALA LUMPUR (Sept 13): CIMB Bank Bhd and CIMB Islamic Bank Bhd have rolled out preferential financing rates for new hybrid vehicles and residential properties certified under the Green Building Index (GBI).

CIMB CEO of group consumer banking Samir Gupta said the move marks another step towards CIMB embracing environmental, social and governance (ESG) principles group-wide.

In a statement today, CIMB said its customers will be offered 10 basis points (0.10%) lower interest rate versus the applicable promotion interest rate for new hybrid vehicles, with minimum financing of RM70,000 and tenure of up to nine years, as well as for GBI-certified residential properties.

The rates are applicable to properties under construction, as well as for completed properties with loan tenure of up to 35 years, or the applicant's age up to 70 years old, whichever is earlier.

CIMB CEO of group Islamic banking Rafe Haneef said these offers support CIMB’s commitment to embed sustainability principles group-wide, while also supporting the global initiative for responsible banking, through the group’s membership of the United Nations’ environment programme's finance initiative principles for responsible banking.

CIMB said it is currently the only banking group in Malaysia and Asean to be a founding member of the sustainable initiative, together with 26 other leading banks from five continents and 19 countries.

GBI is an industry-recognised green-rating tool used to assess buildings in order to promote sustainability in the built environment. — theedgemarkets.com

TOP PICKS BY EDGEPROP

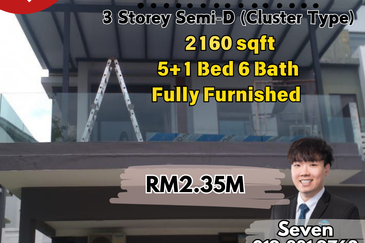

SS 21, Damansara Utama

Petaling Jaya, Selangor

Iconia Garden Residence @ Taman Impian Emas

Johor Bahru, Johor

The Canal Garden South, Horizon Hills

Iskandar Puteri, Johor