Tiong Nam Logistics Holdings Bhd (Aug 28, RM1.01)

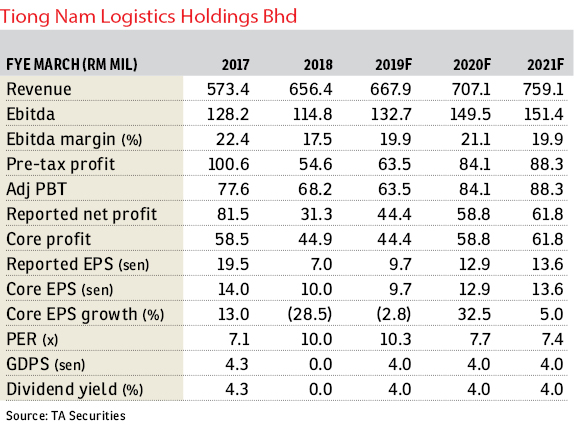

Upgrade to buy with an unchanged target price (TP) of RM1.10: Tiong Nam Logistics Holdings Bhd’s core profit for the first quarter of financial year 2019 (1QFY19) of RM8.1 million accounted for 18.1% of our full-year forecast and 17.3% of consensus estimates. We consider the result within expectations as we expect 2QFY19 earnings will be lifted by higher property sales during the zero-rated goods and services tax (GST) period. 1QFY19 revenue and core profit jumped 10.1% and 29.9% year-on-year (y-o-y) to RM155.1 million and RM8.1 million respectively. This was underpinned by the logistics and warehouse (L&W) division, where revenue rose 6.3% y-o-y on the back of higher occupancy rate of above 70%. Earnings before interest, taxes, depreciation and amortisation and profit before tax (PBT) margins recovered to 12% (versus 9% in 1QFY18) and 3% (versus 1% in 1QFY18) as a result of recovery in occupancy rate. This more than offset a lower contribution from the property segment, where PBT declined by 27.9% y-o-y to RM6.4 million due to an unfavourable sales mix.

Quarter-on-quarter, 1QFY19 revenue and core profit declined by 9.2% and 15.6% mainly due to absence of progress billing from Pinetree Residence. The L&W segment registered a sequential rise in PBT for three consecutive quarters. The profit has increased gradually from a loss before tax of RM3.9 million in 2QFY18 to RM3.9 million in 1QFY19. We fine-tune our FY19 to FY20 earnings projections by 0.2% after incorporating audited FY18 accounts into our model.

Management said the group secured new sales of RM10 million from Tiong Nam Business Park @ Batu Pahat 8 project year to date (YTD). Also, it sold completed units worth RM40 million YTD, which we think will be recognised in 2QFY19. The group is confident of achieving property sales of RM100 million for FY19. For the logistics and warehouse division, the movement of cargo was slow in 1QFY19 as consumers could have postponed their purchases to zero-rated GST period. Tiong Nam secured two new clients — O-I BJC Glass Malaysia and Jotun — for its logistics and warehousing services, which would bode well for the group’s future earnings. We maintain Tiong Nam’s sum of parts valuation at RM1.10 per share. We upgrade the stock to “buy”, from “sell” as we believe the L&W segment has gained the economies of scale when the warehouses’ occupancy rates recovered to above 70%. — TA Securities, Aug 28

This article first appeared in The Edge Financial Daily, on Aug 29, 2018.

For more stories, download EdgeProp.my pullout here for free.