Construction sector

Maintain overweight: The project delivery partner (PDP) contract for the high-speed rail (HSR) Malaysian infrastructure works was split between the YTL Corp-TH Properties and MRCB-Gamuda consortiums.

We believe the Gamuda-George Kent MMC Corp (GGM) consortium could also win part of the Klang Valley mass rapid transit Line 3 (MRT3) project. We remain “overweight” on the construction sector. We met up with Malaysia Rail Link and gather that the Malaysian subcontracts for the East Coast Rail Link (ECRL) project is expected to be rolled out in the second quarter (2Q18).

The GGM consortium and China Communications Construction Co are reported to have been shortlisted for the MRT3 turnkey with financing contract and could share the civil works worth about RM45 billion. We believe both consortiums have the technical capabilities to undertake the project. But awarding the contract to a local player such as GGM will ensure a higher economic impact with more local sourcing of materials and subcontract services.

MRCB-Gamuda (north section) and YTL-TH (south section) received letters of intent from MyHSR Corp for the Kuala Lumpur-Singapore HSR. The Malaysian infrastructure PDP contract is estimated to be worth RM30 to RM35 billion. This will kick-start the implementation of the project once the PDP terms are finalised in 2Q18. Potential engineering consultant and contractor beneficiaries are HSS Engineering, IJM Corp, Mudajaya, Sunway Construction, WCT, Ahmad Zaki, Gadang, TRC Synergy and TSR Capital.

We believe the construction stocks will rally post the 14th general election (GE14) assuming there is no change in government. GE14 uncertainties led to the pre-election correction in construction stock prices. Construction stocks rallied post election in four out of five past GEs but declined in 2008 due to global financial crisis concerns and Barisan Nasional losing its two-thirds majority in Parliament.

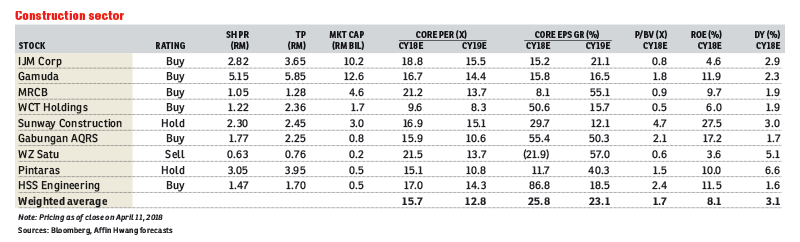

We believe potential news flow on contract awards for the MRT3, ECRL and Pan Borneo Highway Sabah projects will support the outperformance of the construction sector in 2018 and we maintain our “overweight” call. Our top “buys” are Gamuda (large cap), MRCB (mid cap) and HSS (small cap). Gamuda is also selected as one of Daiwa global strategist Paul Kitney’s top picks. — Affin Hwang Capital Research, April 12

This article first appeared in The Edge Financial Daily, on April 13, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Amaya Residences @ Damansara Avenue

Damansara, Kuala Lumpur

Kawasan Perindustrian Balakong

Balakong, Selangor

Tasik Heights Apartment

Bandar Tasik Selatan, Kuala Lumpur

Saville @ The Park - Twin Villa

Bangsar South, Kuala Lumpur