YTL Hospitality Real Estate Investment Trust (March 28, RM1.09)

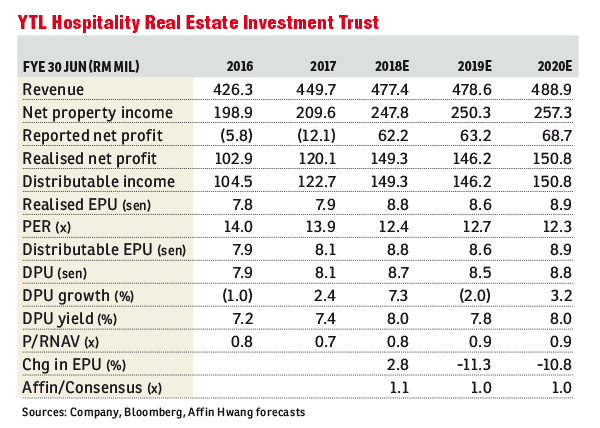

Maintain buy with a lower target price (TP) of RM1.35: We reiterate our “buy” rating on YTL Hospitality Real Estate Investment Trust (YTL REIT), an underappreciated owner of luxury hotels with an established operational track record. At an 8% financial year 2018 estimated (FY18E) yield, YTL REIT looks attractive, offering one of the highest yields among its regional peers. Similarly, this REIT’s price-to-book of 0.76 times is also among the lowest compared with peers.

Approximately 49% of YTL REIT’s cumulative six months of FY18 net property income (NPI) was derived from hotel assets under master leases with stable, highly visible earnings streams. The remaining 51% of NPI was contributed by three hotels in Australia that enjoy rising occupancy rates and stable average daily rates. Looking into 2018 to 2019, we are positive on the Sydney hotel market and are neutral on Melbourne and Brisbane hotel markets.

YTL REIT has acquired 13 assets post its restructuring in 2011. Twelve of these have seen an increase in market value and most are delivering NPI yields of over 6.5%. YTL Corp has an extensive hotel portfolio. Moving ahead, we expect further asset injections from YTL Corp. In view of its track record, we expect these assets injections, if materialised, to be earnings-accretive.

We expect YTL REIT to deliver 12% earnings per unit (EPU) growth in FY18E, driven by the contribution from Majestic KL and higher earnings from its Australian hotels. However, we are cutting our FY18E to FY20E core profit forecasts by 3% to 11%, imputing a stronger ringgit (versus the Australian dollar) and lower hotel occupancy rates in conjunction with a planned renovation at its Brisbane Marriott hotel. We lower our dividend discount model-derived TP to RM1.35 from RM1.61 after incorporating our earnings cut and raising the cost of equity to 8.5% (from 7.9%).

We continue to like YTL REIT for its positive earnings outlook and attractive valuation (compared to regional peers and its historical average). Its master lease agreements (around 49% of NPI) provide a long-term, steady income stream while the Australian hotels (under management contracts) have a positive market outlook. At 8% FY18E yield and 24% discount to net asset value, YTL REIT’s valuation looks attractive.

Rerating catalysts include EPU growth, driven by the contribution from its new asset (Majestic KL) and higher occupancy/day rates at its Australian hotels. Elsewhere, YTL REIT’s unique asset portfolio (the only hospitality pure play among Malaysian REITS [MREITs]) may attract interest from yield seekers as they switch out of retail-centre MREITs that are facing a challenging operating environment. — Affin Hwang Investment Bank Research, March 28

This article first appeared in The Edge Financial Daily, on March 29, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

The Stride Strata Office @ BBCC

Pudu, Kuala Lumpur

The Stride Strata Office @ BBCC

Pudu, Kuala Lumpur