Gamuda Bhd (March 26, RM5.11)

Maintain neutral with a higher target price (TP) of RM5.25: Bright prospects beckon for Gamuda Bhd, as a strong influx of mega projects is expected to contribute to its current estimated unbilled order book of RM7.7 billion by another +15%. We expect Gamuda to win subcontracting jobs from the Gemas-Johor Bahru double-track railway project that has been awarded to YTL Corp Bhd.

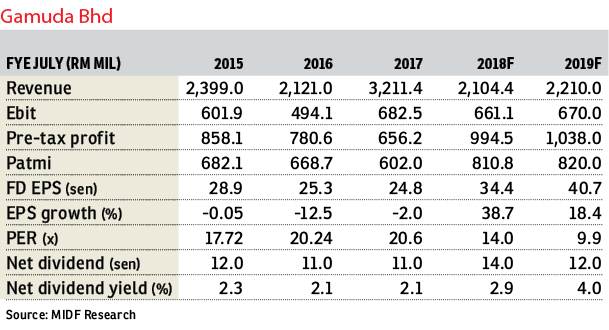

Gamuda’s six months of financial year 2018 (6MFY18) profit after tax and minority interest registered RM414.2 million (+26.1% year-on-year [y-o-y]), reflecting positive revenue increments from the construction and property segments. In addition, its 6MFY18 earnings met our and the street’s target at 51% and 50% of full-year estimates respectively. Gamuda’s 6MFY18 results met our estimate as we have assigned a lower construction progress billing rate for the cumulative period due to project completion.

The construction segment registered a healthy increase in revenue to RM795.8 million (+33.32% y-o-y) and profit before tax of RM729.3 million (+41.6% y-o-y). So far, we are confident that the progress of mass rapid transit Line 2 (Sungai Buloh–Serdang–Putrajaya) and the Pan Borneo Highway (Pantu Junction to Batang Skrang) will be on schedule. Thus, we maintain our current earnings estimates.

We maintain our “neutral” recommendation due to its year-to-date share price run-up with an adjusted TP of RM5.25 per share based on sum-of-parts valuation. We have refined our valuation to reflect changes in debt value. — MIDF Research, March 26

This article first appeared in The Edge Financial Daily, on March 27, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Canal Gardens, Kota Kemuning

Kota Kemuning, Selangor

Encorp Strand Garden Office

Petaling Jaya, Selangor

Genting Permai Royale Resort

Genting Highlands, Pahang

MERU VALLEY RESORT (GOLF VISTA APARTMENT

Kinta, Perak

Canal Gardens, Kota Kemuning

Kota Kemuning, Selangor

Encorp Strand Garden Office

Petaling Jaya, Selangor

Genting Permai Royale Resort

Genting Highlands, Pahang

MERU VALLEY RESORT (GOLF VISTA APARTMENT

Kinta, Perak