S P Setia Bhd (March 9, RM3.15)

Maintain outperform with an unchanged target price (TP) of RM4.10: S P Setia Bhd is buying the remaining 50% stake in Setia Federal Hill for a total cash consideration of RM431.9 million (RM385 per square feet [psf]), at a 10.9% premium to the adjusted net asset value of the project.

The proposed acquisition is expected to be concluded by the third quarter of 2018. Post this acquisition, S P Setia will own 100% of the project. The 51.57-acre (20.87ha) land is located in Jalan Bangsar, for which S P Setia entered into a land-swap deal for the initial 50% stake back in 2011.

Setia Federal Hill’s new estimated gross development value (GDV) of RM20.2 billion is higher than what was quoted in S P Setia’s latest list of remaining GDV (previously RM14.3 billion) with a 15-year development period. The price tag of the remaining 50% stake in Setia Federal Hill is attractive considering that the market value of the land is RM1,050 psf and the implied land cost-to-GDV ratio of 4% is rare nowadays.

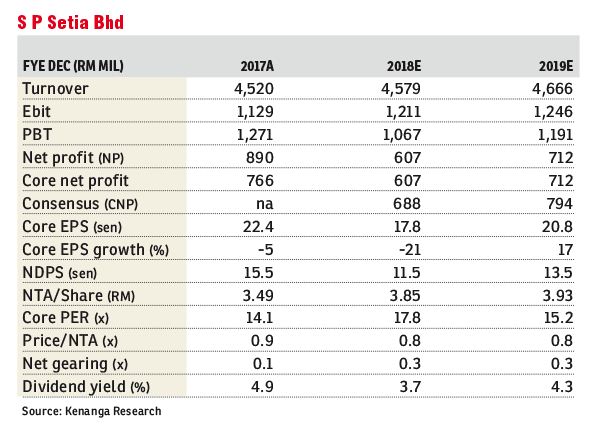

The project will be funded by the proceeds from the Islamic redeemable convertible preference shares completed in December 2016. We expect net gearing for financial year 2018 (FY18) to increase from 0.24 times to 0.28 times, which is still at a healthy level.

We were surprised by the acquisition, considering that the group had only recently completed its acquisition of I&P Group Sdn Bhd and did not expect any sizeable acquisitions to happen so soon; but we think it does make sense for S P Setia since it already owns 50% of the project and has the balance sheet headroom. Overall, we are positive about the acquisition in the medium to longer term given the attractive price tag to own 100% of a rare piece of prime land in Bangsar while also not expecting any near-term earnings impact. We expect the project to be launched from FY20 onwards. Thus, we maintain our earnings estimates.

Our fixed deposit sum of parts (SoP) is increased by 4% to RM7.60 post accounting for the additional 50% stake and a higher GDV for Setia Federal Hill. However, we opt to maintain our TP of RM4.10, which implies a wider SoP discount of 46% at -0.5 standard deviation (from 44%) as we do not expect near-term earnings impact. We believe that the valuation of I&P has yet to be reflected in

S P Setia’s current price as its share price has not been rerated much since the announcement of the I&P acquisition. We also hope the recent placement will help alleviate the tight trading liquidity. However, in light of investors’ aversion towards property stocks, investors may need to take a longer-term view on the stock for the value to be reflected in its share price. — Kenanga Research, March 9

This article first appeared in The Edge Financial Daily, on March 12, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Connaught (Taman Sri Cendikia)

Cheras, Kuala Lumpur

Taman Cheras (Formerly Yulek Heights)

Cheras, Kuala Lumpur

TAMAN CASAFABULOSA (HILLTOP 2)

Pantai Barat Selatan, Sabah

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan