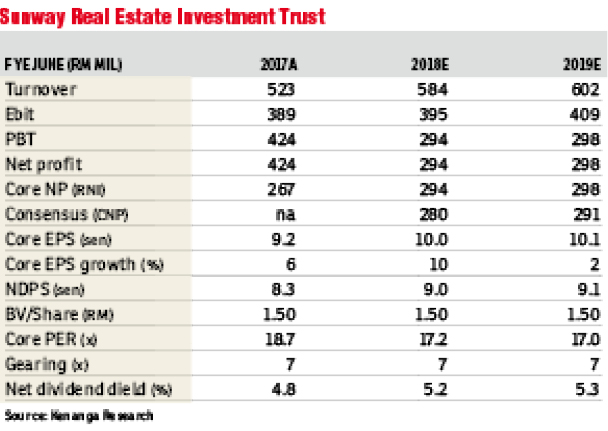

Maintain outperform with a higher target price (TP) of RM1.90: First half 2018 (1H18) realised net income (RNI) of RM148.8 million came in within expectations, making up 53% and 51% of consensus and our estimates, respectively. Second quarter 2018 (2Q18) gross dividend per unit (GDPU) of 2.38 sen includes a non-taxable portion of 0.38 sen, bringing 1H18 GDPU to 5.05 sen which is also within our expectation at 51% of financial year 2018 (FY18) GDPU of 10 sen.

Year-on-year to year-to-date gross rental income (GRI) was up by 11% driven by all segments, retail (+4.4%) on all assets from stable occupancy and positive reversions, save for SunCity Ipoh Hypermarket, hotel segment (+47.2%) mostly from Sunway Pyramid Hotel post the completion of the refurbishment in June 2017, and Sunway Putra Hotel from higher occupancy and average room rates (ARR), and contributions from the SEA and PARA games in 1Q18, office segment (4.1%), save for Wisma Sunway on a slight tenant downsizing and marginal decline at Sunway Tower and others segment (+25.1%) from the completion of the acquisition of the industrial asset in Shah Alam in August 2017.

Net property income (NPI) margins improved slightly by 1.5 percentage points (ppt) on lower maintenance cost at Sunway Pyramid, allowing RNI to increase by 14%. This is after stripping off the RM3.2 million court award for Sunway Putra in 2Q17 as it is non-recurring. Quarter-on-quarter, RNI was down by 11% on the back of a flattish GRI, higher operating cost (+26%) from increased maintenance cost at Sunway Pyramid and Sunway Carnival, and allowance for doubtful debts, and higher financing cost (+4%) from Shah Alam Industrial asset acquisition. As a result, the RNI margin was down 6.3ppts.

FY18 capital expenditure expenses will mostly be for Sunway Carnival Extension in 2H18. As such, we are expecting RM60 million to RM100 million in FY18 to FY19. FY18 to FY19 has minimal leases up for expiry at 9.5% to 11.8% of net lettable area. We expect mid- to single-digit reversions for retail and low- to mid single-digit reversions for office assets, while we expect flattish growth for the hospitality segment’s ARR and occupancy.

Maintain “outperform” but increase our TP to RM1.90 (from RM1.87) post rolling forward our valuations to FY19 GDPS/NDPS of 10.1/9.1 sen (from FY18 GDPS/NDPS of 10.0/9.0 sen), based on an unchanged target gross yield of 5.4% (net: 4.9%) on an unchanged +1.40 ppt spread to the 10-year Malaysian government securities (MGS) target of 4.00%.

Our applied spread is at the higher end of retail mortgage real estate investment trust (MREIT) peers’ spreads (+0.8 to 1.4 ppt), accounting for slight earnings fluctuations for the office and hotel segments. However, the largest portion of earnings is driven by Sunway real estate investment trust (SUNREIT)’s stable retail component (74% of GRI). Even so, SUNREIT is commanding attractive gross yields of 5.9%, which is on par with retail MREITs’ average of 5.9% and close to MREIT peers (more than RM1 billion market capitalisation) at 6.1%, warranting an “outperform” call.

We are bullish on most MREITs (save for KLCC and Axis Reit), premised on their attractive gross yields of 5.9% to 7.1% (5.3% to 6.4% net yield), on minimal earnings risk going forward, and backed by a stable MGS outlook. — Kenanga Research, Feb 7

This article first appeared in The Edge Financial Daily, on Feb 8, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Springhill

Port Dickson, Negeri Sembilan

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Horizon Residence (Dwi Mutiara)

Bukit Indah, Johor

Imperial Jade Residenz @ Bandar Seri Alam

Masai, Johor