Gadang Holdings Bhd (Feb 7, RM1.06)

Maintain buy with an unchanged target price of RM1.69: Gadang has entered into a conditional sale and purchase agreement (SPA) with GP Views Development Sdn Bhd to acquire approximately 78 acres (31ha) of freehold land in Pontian, for RM149 million, to be paid fully in cash.

The land is surrounded by residential developments such as Setia Eco Gardens, Nusajaya, Bukit Indah and Horizon Hill, and is approximately 20km from the Malaysia-Singapore Second Link. The land is accessible via Jalan Tanjung Kupang which is connected to the Pontian Highway and Second Link Highway.

In the agreement, the vendor shall procure the master development layout approval for residential development with a density of 12 units per acre, with conversion premium and statutory contribution being paid by the vendor. Also, the requirement for affordable housing imposed by the relevant authorities shall not be applicable to the said land. Furthermore, the land is to be completed with primary infrastructure such as main roads, drainage, electricity and water supply, sewerage treatment and the planting of greenery.

Upon the execution of the SPA, a sum of RM7.5 million shall be paid to the vendor. The balance purchase consideration of RM141.5 million shall be paid in tranches upon the fulfilment of conditions precedent.

The purchase price translates into a rate of RM43.9 per sq ft. We understand that the land is intended for residential development with a preliminary gross development value (GDV) of RM550 million. We deem the purchase consideration of RM149 million (inclusive of land, conversion premium and primary infrastructures costs), which translates into about 27% of the GDV, to be fair.

Based on the assumed GDV and density, the average selling price per unit works out to be RM588,000, which we view as attractive. As a reference, a neighbouring development at Setia Eco Gardens prices a 20ft by 70ft double-storey house from RM608,000 and a 22ft by 70ft double-storey house from RM672,000.

The land acquisition is expected to be completed in second quarter 2019 and the indicative project launch date is said to be in second half 2019. We expect the project to be well-received given the affordable pricing for freehold landed property and accessibility to Pontian Highway and Second Link Highway. The proposed KL-Singapore High Speed Rail with a station in Iskandar Puteri should also boost demand for property in the vicinity.

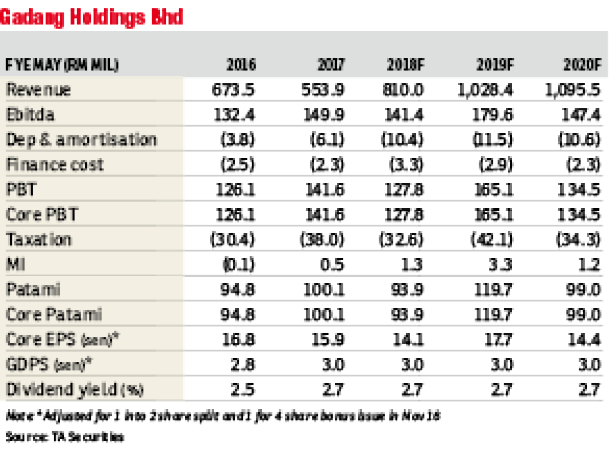

Maintain financial year 2018 (FY18) to FY20 earnings forecasts pending further details and development on the land acquisition. — TA Securities, Feb 7

This article first appeared in The Edge Financial Daily, on Feb 8, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

KSL Residence 2 @ Kangkar Tebrau

Johor Bahru, Johor

KSL Residence 2 @ Kangkar Tebrau

Johor Bahru, Johor

TAMAN MEDANG (MANTIN)

Seremban, Negeri Sembilan

TAMAN SEREMBAN FOREST HEIGHTS

Jelebu, Negeri Sembilan

Taman Perindustrian Meranti Jaya

Puchong, Selangor