When George Town in Penang and Melaka city were inscribed into Unesco’s World Heritage List in 2008, it was an international recognition that the nation was proud of. Since then, these two cities have seen a renewed interest in heritage preservation and investment.

Eager to play their roles in the conservation of the unique multicultural traits of these pre-war properties, many have invested money, time and effort in fashioning them into boutique hotels, cafes, restaurants and even museums or galleries.

However, just what constitutes a heritage property? If you are interested in buying one, what should you look out for? In terms of dollars and cents, are they worth putting your money in?

According to Savills Malaysia Sdn Bhd executive chairman Datuk Christopher Boyd, the term “heritage building” is loosely used and generally covers buildings that are at least pre-World War II and have a distinct design or visual appearance.

“Examples are old shophouses with eclectic features including Roman and Greek facades, as well as those built in Art Deco style. You can also find Mughal features and some older residences built in the classic Anglo-Indian style, which I find very attractive,” he shares with EdgeProp.my.

Unique challenges

Boyd notes that Malaysia’s built heritage is protected through a number of controls. Hence, a check with the local authorities is essential before embarking on investing in one.

“Buildings within the Unesco Heritage Zones in Penang and Melaka are stringently controlled as to their use. Changes, both external and internal, must be authentic in design and materials. This obviously makes adaptive re-use challenging and a typical problem is meeting contemporary fire-safety requirements.

“Under our conservation laws, some state governments have gazetted certain buildings as heritage buildings, so they fall under a rigid set of planning and building guidelines. In certain cases, even without gazettal, a local authority can decide to [take] control,” he highlights.

Andrew Lee, the founder of VCR Cafe — housed in a pre-war shophouse along Jalan Galloway, off Jalan Pudu, Kuala Lumpur — says that running a business in a heritage building has its pros and cons. Yes, many are drawn to the charms of a pre-war property, but the word to note is “pre-war”, which means a lot of refurbishment and continuous maintenance will have to be done.

“There is a lot of upkeep. The first two years of running the cafe business was a nightmare — the roof leaked, things kept falling apart, so we’re constantly fixing something in the cafe.

“But it’s all part and parcel of investing in a pre-war building. I like the building so much that I just take all the problems in my stride. Having said that, I’m not keen to move into another heritage building in future,” he quips.

Nevertheless, despite the challenges that come with its upkeep, the market for heritage property has been sizzling, with George Town and Melaka city centre achieving record-high selling prices in 2017.

Soaring prices in George Town

In the capital city of Penang, investments in pre-war buildings have spiked, pushing prices to an all-time high in 2017.

Many of these new owners help to uplift the image of the city by refurbishing and restoring the old, dilapidated pre-war properties, and both prices and rental rates have escalated.

According to Henry Butcher Penang senior vice-president for asset valuation Shawn Ong, 2017 has seen a new high in transacted price of pre-war properties in Penang.

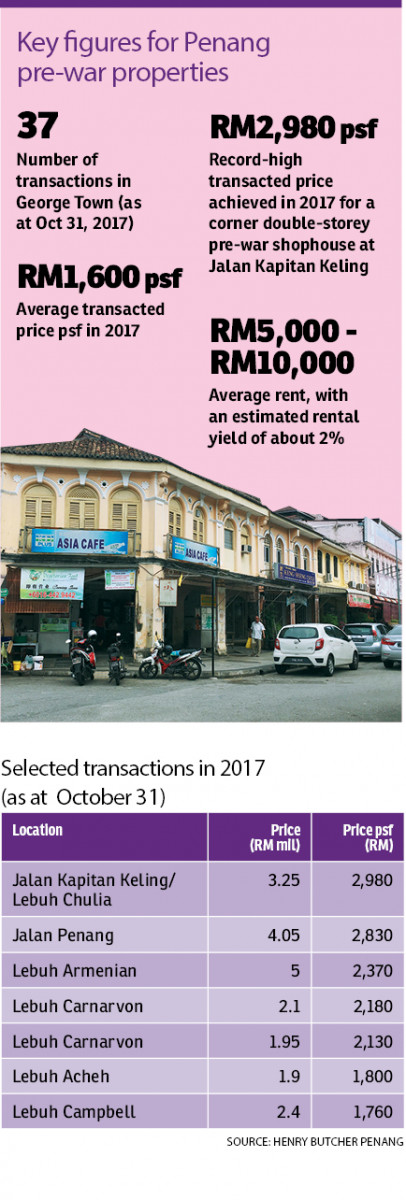

“As of Oct 31, 2017, there were 37 pre-war property transactions in George Town, with the highest price recorded at about RM2,980 psf or RM3.25 million for a corner double-storey pre-war shophouse at Jalan Kapitan Keling.

“2017 has recorded fewer transactions compared to 2016 but price psf has hit a record high of RM2,980 psf — about 24% higher than the highest transaction price recorded in 2016.

“The average transacted price psf for pre-war properties in 2017 was RM1,600 psf (2016: RM1,700 psf). The average price dropped marginally because some pre-war properties with large compounds (land) recorded lower price psf,” he tells EdgeProp.my.

Ong says pre-war properties beyond the core or at the buffer of the Unesco World Heritage Site are being transacted between RM800 psf and RM1,400 psf. He foresees prices to increase due to limited supply, especially those with unique designs and special characteristics.

Similarly in Seberang Perai or mainland Penang, there are many edifices built prior to 1948 that are classified as heritage properties located in major towns such as Kepala Batas, Butterworth, Perai, Bukit Mertajam, Simpang Ampat, Jawi, Nibong Tebal and others.

However, as these heritage properties are not located within the Unesco World Heritage Site, their demand and capital value are substantially lower than those in George Town.

Limited supply drives long-term value

Heritage properties within George Town World Heritage Site offer great opportunities for investors seeking high return on investment, says Ong.

“For heritage property lovers, George Town is definitely one of the best destinations in Asia to invest in.

“Since George Town became a Unesco World Heritage Site in 2008, heritage property prices within the core and buffer zones have skyrocketed (more than 300% since 2008).

“The main reason for the soaring prices was the limited supply within the heritage site that was available for sale, coupled with strong demand from both local and foreign investors.

“According to the George Town World Heritage Special Area Plan, the heritage zone in George Town covers 260ha and comprises 2,569 buildings in the core zone and another 2,444 buildings in the buffer zone.

“Many investors and property speculators who saw the potential snapped up these heritage properties between 2009 and 2011. They resold their properties after two to three years and enjoyed high capital gains of at least 50% from the initial investment.

“For those investors still holding on to their heritage properties, the capital values of their assets are now at least double the amount of their initial costs,” Ong elaborates.

On rental rates, he notes that heritage properties in their original building condition or without any refurbishment within George Town World Heritage Site are still relatively low with rental yields — usually below 2%.

“Tenants usually negotiate for lower rental rates in view of the fact that they are responsible for the repairs and restorations of the heritage buildings. In general, for those of average size and fully refurbished by the owners, the monthly gross rental rates range between RM5,000 and RM10,000 per unit, depending on the exact location and size of the building,” he reveals.

Consult the experts

Prior to restoration of a pre-war property, Ong recommends seeking professional advice and consultation from architects familiar with restoration works or the Penang Heritage Trust, George Town World Heritage Inc, and the Heritage Department of Penang Island City Council (MBPP).

Besides checking the heritage status of the pre-war properties, Ong also advises interested buyers to double-check the building use of the property from the local authority — MBPP. This is because building use may affect the financing package offered by financial institutions as well as the compliance cost that have to be borne by the owner.

“The local council is very strict on the use of a heritage property, so if you want to use a heritage property with residential use for commercial purposes, you’ll have to convert the building use. Not only that, the provision of car park as the requirement for different building uses also varies,” notes Ong.

Prices stabilising in Melaka

CBRE|WTW Melaka senior branch manager Teh Hong Chua describes heritage properties in Melaka as a rare commodity that cannot be replicated or reproduced over time. “So, in the long term, it will always appreciate in value,” he opines.

Henry Butcher Melaka branch manager cum director Lim Chow Wah agrees, saying that investors are looking at long-term capital appreciation.

“The limited supply of pre-war shops are attracting people to invest, but the annual return usually hovers around 3%,” he says.

Teh notes that the heritage properties located within the Melaka Unesco World Heritage Site are bounded by the Stadthuys (or more fondly known as the Red Square) and the four main streets in the area — Jalan Hang Jebat (or Jonker Street), Jalan Tun Tan Cheng Lock (Heeren Street), Jalan Tokong and Jalan Kampung, as well as four perpendicular streets — Lorong Hang Jebat, Jalan Hang Kasturi, Jalan Hang Lekiu and Jalan Hang Lekir.

A heritage-status property in the heritage zone must be over 60 years of age; present heritage features for facade, doors and windows; have roofs clad in Chinese clay tiles with distinctive rounded gabled ends; have interiors decorated with carved teak panels; and have doors and window frames, air wells, courtyards and corridors paved with Melaka tiles.

The Melaka state government has formed Syarikat Kemajuan Pemeliharaan Negeri Melaka to facilitate the conservation of heritage properties in the city by providing partial grants and free advisory and mediator services.

Both the city council Majlis Bandaraya Melaka Bersejarah and the local Land and Mining Office provide discounts or exemptions on property tax and land tax, respectively, for a specific period equivalent to conservation cost for such buildings.

“Heritage property is unique and has irreplaceable building architectural artworks, [so] any business that operates in the building will offer different experiences to customers. As such, the business operators perhaps can charge a premium,” says Teh.

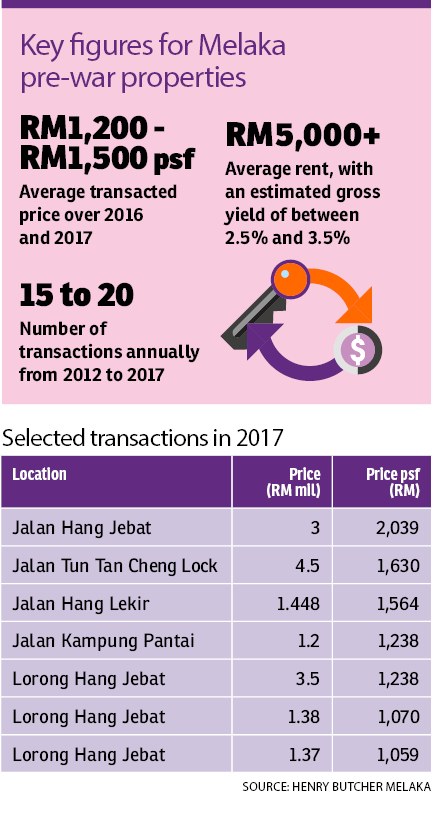

Henry Butcher Melaka’s Lim notes that pre-war shops in Melaka are transacted at an average of between RM1,200 psf and RM1,500 psf over 2016 and 2017, which is a record-high price range.

![Teh: Heritage property is unique and has irreplaceable building architectural artworks, [so] any business that operates in the building will offer different experiences to customers. (Photo by CBRE/WTW) Teh Hong Chua](http://dbv47yu57n5vf.cloudfront.net/s3fs-public/editorial/my/2018/January/26/THC%281%29.jpg)

“From 2012 to 2017, transaction volume was quite stable with about 15 to 20 transactions annually. It was in 2012 that we saw a big jump in price, but from 2016 onwards, we see prices stabilising.

“In 2012, pre-war shops in Melaka were transacted between RM600 psf and RM800 psf. Since then, prices have been climbing to the RM1,200 psf to RM1,500 psf range today, so it’s a 100% price growth since 2012,” offers Lim.

Depending on the location and size of the property, the average rent is from RM5,000 onwards, with an estimated gross yield of between 2.5% and 3.5%, he adds.

Lim also notes that the lot sizes of pre-war shops in Melaka are very unique, an attractive factor for investors.

“There is no standard size for these pre-war shops. Some may have a 12ft frontage and 100ft depth, while some are 20ft by 100ft, or 20ft by 50ft. You get all sorts of sizes here. So if the tenant or property owner is running a hospitality business, a pre-war unit with a 20ft frontage may be suitable.

“These pre-war shops usually boast built-up sizes between 1,500 sq ft and 2,000 sq ft. There are also some odd ones that are as small as 600 sq ft or as big as 3,000 sq ft,” he says.

According to CBRE|WTW’s Teh, the pre-war shophouses at Jonker Street and Heeren Street are the most popular as they are located in tourism hotspots.

Teh also expects demand for pre-war shophouses in Melaka’s Unesco Heritage Zone to continue due to their scarcity and because Melaka is a tourism state that promises a high volume of tourists.

In the near term, he foresees prices to remain stable with some authentic buildings attempting to reach new highs.

Kuala Lumpur

None of the old areas of Kuala Lumpur has been gazetted or declared a heritage zone despite their colourful pasts, but several buildings have been gazetted as “heritage building” and “national heritage” by the National Heritage Department under the Ministry of Tourism and Culture Malaysia.

In Kuala Lumpur, there are 44 heritage buildings where 28 are within Pulapol — the Malaysian Police Training Centre — and 27 national heritage status buildings.

Past transactions showed that multi-storey commercial pre-war buildings located in areas such as Jalan Pudu were transacted between RM990,000 and RM12.15 million from December 2012 to April 2017.

For pre-war buildings along Jalan Sultan, which is a stone’s throw away from Petaling Street, there are only two transactions in December 2014 and March 2015 where two units of 2-storey shophouses were sold for RM5.2 million and RM4.7 million respectively.

In Jalan Tun HS Lee, the most significant transaction in recent years was the sale of the 5-storey Lee Rubber Building to Singapore-based GF Land Sdn Bhd for RM29 million in December 2015. In the same vicinity, 2- and 3-storey pre-war buildings were transacted between RM1.38 million and RM4.85 million in the period of April 2013 to July 2016.

This story first appeared in EdgeProp.my pullout on Jan 26, 2018. Download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Setiawangsa

Taman Setiawangsa, Kuala Lumpur