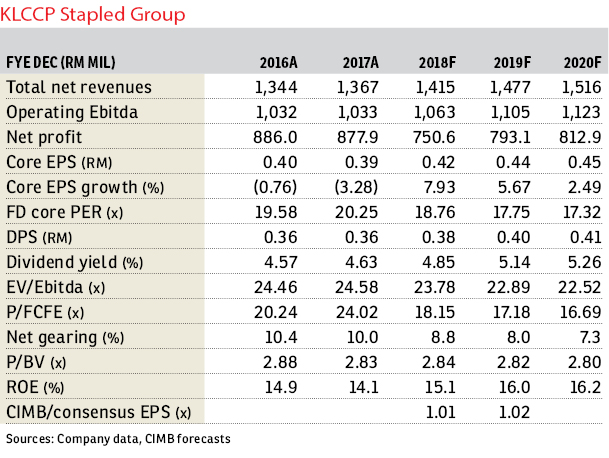

KLCCP Stapled Group (Jan 25, RM7.80)

Maintain hold with a target price of RM7.83: Stripping off a fair value (FV) gain on investment property of RM182.5 million, KLCCP Stapled Group’s financial year 2017 (FY17) core net profit came in at RM695.4 million (-2.2% year-on-year [y-o-y]). This was below our and market expectations at 96% and 95% of respective full-year forecasts. While revenue was in line with our expectations, the deviation in earnings from our forecasts came mainly from higher-than-expected minority interest and taxation. We excluded a back charge of RM3.5 million in rental income in the second quarter of FY16 (2QFY16) and a RM2.5 million write-off in the first nine months of FY16.

KLCCP declared a 4QFY17 dividend per share (DPS) of 10.4 sen (+5% y-o-y), bringing FY17 DPS to 36.2 sen (+1.4% y-o-y), in line with our DPS expectation of 36.3 sen for FY17. KLCCP’s 4QFY17 revenue rose 2.1% y-o-y or 3.4% quarter-on-quarter (q-o-q), driven by a higher hotel revenue (11.3% y-o-y; 11.5% q-o-q), on the back of stronger occupancy per available room and higher average room rates as the newly refurbished guest rooms in Mandarin Oriental gradually returned to inventory (as at September 2017, 277 rooms ranging from Club Suites to Deluxe rooms had completed refurbishments). Better hotel revenue trickled down to hotel profit before tax (PBT) in 4QFY17 (48.7% y-o-y; 85.8% q-o-q). 4QFY17 PBT grew 2.3% y-o-y or 3.1% q-o-q.

FY17 revenue rose 2% y-o-y as all segments posted revenue growth. However, FY17 PBT (excluding the FV gain on investment property) grew by a softer 0.2% y-o-y, dragged by higher manpower costs and lower interest income from the management services segment. The hotel segment turned profitable in FY17, while office-segment earnings remained stable (+1% y-o-y) and continued to be the main pre-tax profit contributor (51% of PBT excluding the FV gain on investment property), primarily on the back of long-term office tenancy agreements. KLCCP’s earnings should continue to be sustained by: stable income from its office assets, with its solid 100% occupancy and long-term leases, the gradual completion of Suria KLCC’s tenant remixing exercise (expected to be completed in FY18), which should bring back occupancy rates for the mall to the historical 98% level and provide a better tenant mix, and increasing occupancy and better room rates at Mandarin Oriental as refurbished rooms return to inventory (expected to conclude in FY19).

We maintain our “hold” call on KLCCP, given the lack of catalysts in the near term. We believe KLCCP deserves to trade at a premium over its peers due to its size, prime locations and secured office assets (long-term and triple net leases) as well as a strong brand name of its retail assets. Its dividend yield, backed by stable earnings, should attract investor interest, although we note that at current valuations, its FY18 to FY20 forecast yields of 4.8% to 5.2% are slightly unattractive versus the sector average of 5.6% to 5.8%. — CIMB Research, Jan 25

This article first appeared in The Edge Financial Daily, on Jan 26, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bayan Lepas Industrial Park

Bayan Lepas, Penang

Taman Perindustrian Batu Kawan

Batu Kawan, Penang

Taman IKS Bukit Minyak

Bukit Mertajam, Penang

Taman Perindustrian Batu Kawan

Batu Kawan, Penang

Perindustrian Bukit Minyak

Simpang Ampat, Penang

Bandar Baru Sungai Buloh

Sungai Buloh, Selangor

HillPark Avenue @ Puncak Alam

Puncak Alam, Selangor

i32 Puchong Industrial Park

Puchong, Selangor

SS 21, Damansara Utama

Petaling Jaya, Selangor