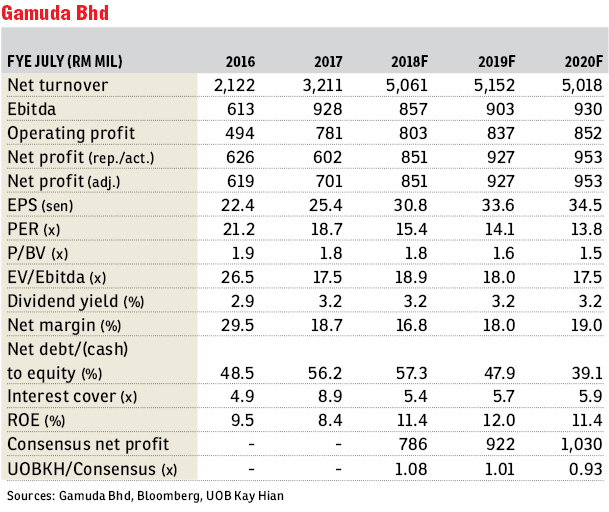

Gamuda Bhd (Dec 11, RM4.80)

Maintain buy with a target price of RM6: Gamuda Bhd held an analyst briefing last Friday. Discussions during the briefing included updates for mega construction jobs that the group is gunning for, including: i) the project delivery partner (PDP) for the Kuala Lumpur-Singapore High-Speed Rail (HSR); ii) East Coast Rail Line (ECRL); and iii) mass rapid transit 3 (MRT3). It is also optimistic about securing an infrastructure job in Singapore.

Back in June, the group shared its ambitious plan to secure RM10 billion worth of construction jobs every year for the next two years. But it has now reduced its target order book wins to RM6 billion to RM8 billion per annum for the next two financial years. The announcement was not a surprise, as we had already assumed more conservative order book wins of RM5 billion per annum for the next two financial years.

The HSR is divided into two separate components, comprising: 1) the AssetsCo (responsible for the systems and other HSR-related technologies); and 2) the InfraCo (responsible for civil and structural works in Malaysia). Gamuda, together with Malaysian Resources Corp Bhd, is eyeing the PDP role for the InfraCo of the HSR. Total infrastructure works required for the Malaysian-side HSR are worth between RM35 billion and RM40 billion. Tenders for the AssetsCo and InfraCo are due to close early next year; the outcomes could likely be made known sometime in the second quarter of 2018 (2Q18) to 3Q18.

It has tendered for a package measuring about 150km for the ECRL. It expects a decision to be announced by 1Q18. It has been negotiating with the turnkey contractor to potentially secure a job for the ECRL. But we do not expect the award to be sizeable, as the total local content of the ECRL would be valued up to RM16.5 billion — to be shared among many contractors.

Although Gamuda has lost the PDP role for MRT3, we think that it could still potentially participate in some of the underground construction work for the rail line. Of the 40km line, 32km would be underground. Taking the base price of RM1 billion per km (based on MRT2), the value of underground works for MRT3 could be worth north of RM32 billion. We do not discount the possibility of Gamuda participating in some of the underground tunnel construction given that: a) it has the advantage of knowing the soil conditions of Kuala Lumpur City Centre; and b) its current ownership of 12 tunnel boaring machines were used for MRT1 and MRT2. But should it undertake the job, we think margins would not be as lucrative as MRT1/2 (of about 14% of the profit before tax level), as Gamuda would take on a subcontractor role.

In the first quarter of financial year 2018 (1QFY18), the group secured about RM903 million (+110% year-on-year) of new property sales, and is on track to meet its RM3.5 billion sales target for FY18. Sales were mainly driven by its overseas projects. For domestic developments, sales have been reasonably strong. Going forward, we expect lower margins for the property development division due to a high upfront costs for its Klang Valley township developments and higher recognition of overseas projects with lower margins. — UOB Kay Hian Research, Dec 11

This article first appeared in The Edge Financial Daily, on Dec 12, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Melawis (Taman Heng Luen)

Klang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Commerce One

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

City of Green Condominium

Seri Kembangan, Selangor

Periwinkle @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Desa Green Serviced Apartments

Taman Desa, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor