Sime Darby Property Bhd (Dec 8, RM1.28)

Initiate add call with a target price (TP) of RM1.85: Sime Darby Property Bhd is a prominent property developer with the largest land bank in Malaysia as at September 2017. Currently, it owns about 20,763 acres (8,402.5ha) of land bank which we estimate has a remaining gross development value (GDV) of RM100.4 billion. The land bank is strategically connected to major highways and located mainly within key growth areas and economic corridors.

Sime Darby Property’s land bank within Negeri Sembilan and Johor is strategically located in close proximity to the Kuala Lumpur-Singapore high-speed rail project (HSR). As Seremban and Muar have been identified as transit stops along the rail line, we believe its property projects in the surrounding areas, like Bandar Ainsdale, Seremban, Nilai Impian 1 and Nilai Impian 2 in Negeri Sembilan, as well as Bandar Universiti Pagoh in Muar, will benefit from the development.

Sime Darby Property has strategic land bank in and around the area earmarked as the Malaysia Vision Valley (MVV), a component of the government’s 11th Malaysia Plan and the National Transformation Plan. The group currently owns 3,196 acres of land within MVV. While we believe its sizeable reserve of land in MVV will underpin Sime Darby Property’s long-term earnings growth, we also think the development of MVV in the short term will likely help buoy its existing projects in Nilai Impian and Bandar Ainsdale.

Following the demerger from Sime Darby Bhd, the group announced a new management team in September, which is tasked with reinventing its growth trajectory. Tan Sri Abdul Wahid Omar is the chairman, Datuk Sri Amrin Awaluddin is the managing director, and Datuk Datuk Tong Poh Keow is the executive director and chief financial officer. We believe Abdul Wahid is a valuable asset to the group given his vast experience and connections in the public and private sectors.

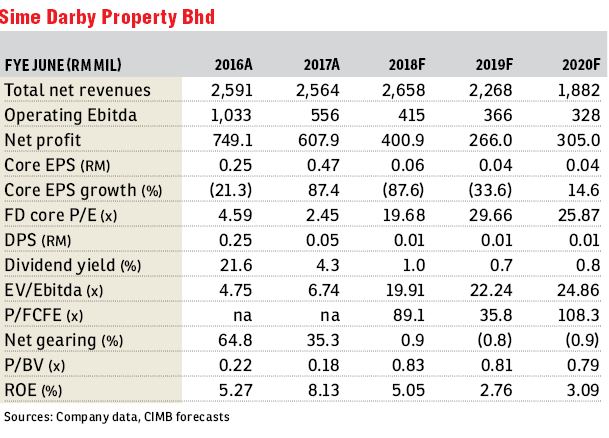

We initiate coverage on Sime Darby Property with an add recommendation. We value the stock based on a 50% discount from our estimate of its revalued net asset valuation, translating into a TP of RM1.85. The large discount compared to an average of 35% for other stocks under our coverage reflects the slower monetisation and longer gestation period of its considerable land bank. We believe the recent share price retracement to 0.8 times the financial year 2018 price-to-book value, which is below peers’ estimates, represents a good opportunity to accumulate the stock. — CIMB Research, Dec 7

This article first appeared in The Edge Financial Daily, on Dec 11, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

DC Residensi (Damansara City)

Damansara Heights, Kuala Lumpur

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor