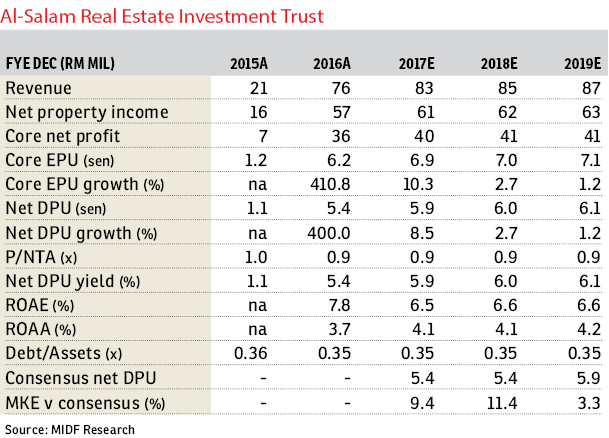

Al-Salam Real Estate Investment Trust (Nov 13, 99.5 sen)

Maintain buy call with a target price of RM1.15: Post meeting with management, we gained better clarity on its short- to mid-term acquisition plans to grow its portfolio. Elsewhere, we remain positive on its existing assets, such as Komtar JBCC, which could remain resilient.

On top of its recent proposal to acquire Mydin Hypermarket Gong Badak (announced in October 2017), we understand that Al-Salam Real Estate Investment Trust (Al-Salam REIT) is currently assessing several properties for acquisition, such as Menara VSQ (office), Galleria@Kotaraya (retail), a KFC plant (industrial) and other QSR Properties (food and beverages).

Total estimated value of the aforementioned properties (including Mydin Hypermarket Gong Badak) is RM775 million — a potential 84% boost to its end-second quarter of 2017 (2Q17) total property value of RM922 million. Al-Salam REIT targets to grow its asset value to the RM2 billion mark in two years.

Komtar JBCC continued to perform favourably. The mall recorded: i) end-September 2017 occupancy of 95% (plus two percentage points [ppts] year-on-year [y-o-y]); ii) year-to-date positive rental reversion; iii) single-digit y-o-y tenant sales growth; and iv) +10% y-o-y in footfall (for the January to October 2017 period).

In the long run, we note that the mall could be enhanced by the Ibrahim International Business District (IIBD) development, which could boost economic activities within the area.

Meanwhile, we note that an adjacent office development, Menara JLand, is due for completion soon, which would also include a link bridge to Komtar JBCC — potentially driving a larger office crowd into the mall.

We remain positive on Al-Salam REIT’s earnings outlook, whereby organic growth would be driven by Komtar JBCC (via positive rental reversion and sustained occupancy rates), while KFCH College and QSR Properties would provide stable, recurring rental income. Al-Salam REIT offers a commendable 2018 net yield of 6% (sector average: 5.3%).

Al-Salam REIT is assessing a handful of properties for acquisition worth RM775 million in total.

As Al-Salam REIT intends to adopt an active acquisition strategy in the near term, we note that funding for the acquisitions could include higher drawdown of borrowings and/or placement of new units (such as private placements and exchanges of units with vendors).

Currently, including the proposed acquisition of Mydin Hypermarket Gong Badak, Al-Salam REIT’s gross gearing could reach 0.44 times, from end-2Q17’s 0.36 times.

The IIBD project was launched in November 2015, and it is a 250-acre (101.17ha) development in Johor Bahru (Komtar JBCC located within the planned business district). The IIBD will be developed by Johor Corp (parent of Al-Salam REIT) and is estimated to carry a gross development value of RM20 billion to RM25 billion. We understand that works on key portions of the project had commenced in the first half of 2017.

We are long-term positive on the development, which could spur population growth and economic activities in Johor Bahru, which in turn increase shopper traffic at Komtar JBCC. — Maybank IB Research, Nov 13

This article first appeared in The Edge Financial Daily, on Nov 14, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Hampton Damansara

Country Heights Damansara, Kuala Lumpur

Hampton Damansara

Country Heights Damansara, Kuala Lumpur

Hampton Damansara

Country Heights Damansara, Kuala Lumpur

Hampton Damansara

Country Heights Damansara, Kuala Lumpur

Antara Genting Highlands

Genting Highlands, Pahang

Palm Hill Residence 2 (Residensi Bukit Palma 2)

Cheras, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor