KUALA LUMPUR (Nov 1): LBS Bina Group Bhd rose as much as 2.6% in the morning trading session today after the group proposed to sub-divide its shares on the basis of one existing ordinary share into two ordinary shares, and subsequently declared a bonus issue on the basis of one bonus share for every 10 subdivided shares held.

At 9.55am, LBS rose five sen to RM1.97 — the highest level since Oct 25. The stock saw some 189,200 shares transacted, for a market capitalisation of RM1.34 billion.

In the filing with Bursa Malaysia yesterday, LBS said the proposed share split is to improve the trading liquidity by way of increasing the number of shares in the issue while also making the price more affordable post-split.

At the same time, the bonus issue is to reward existing shareholders of the group and enable them to have greater participation in the equity of the company.

Meanwhile, PublicInvest Research is neutral on this exercise as share prices will adjust accordingly and proportionately, with no effects on the intrinsic value of the company.

"We do however concede there could be some trading interest and near-term price upsides typical with exercises of such nature.

"We are more excited over LBS's long-term growth prospects and its exposure to the mass-market affordable housing segment, which continues to garner much attention from the public and private sectors alike," said its analyst Ching Weng Jin.

The research house has affirmed "outperform" recommendation on the stock with an unchanged target price of RM2.23, which will be adjusted to RM1.02 post-exercise. The exercise is expected to be completed by January next year. — theedgemarkets.com

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Hexa Commercial Centre

Desa Petaling, Kuala Lumpur

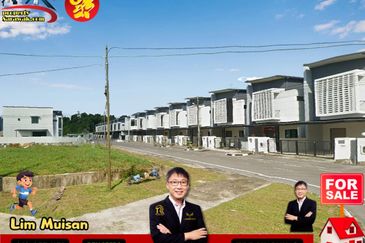

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

Pavilion Damansara Heights

Damansara Heights, Kuala Lumpur