WCT Holdings Bhd (Oct 27, RM1.61)

Maintain buy call with a target price (TP) of RM2.46: Most investors were surprised by WCT Holdings Bhd’s second proposed private placement of up to 10% of share capital. We understand that the private placement was proposed on concern that most of the outstanding WCT-WD warrants are not converted until they expire on Dec 11, 2017.

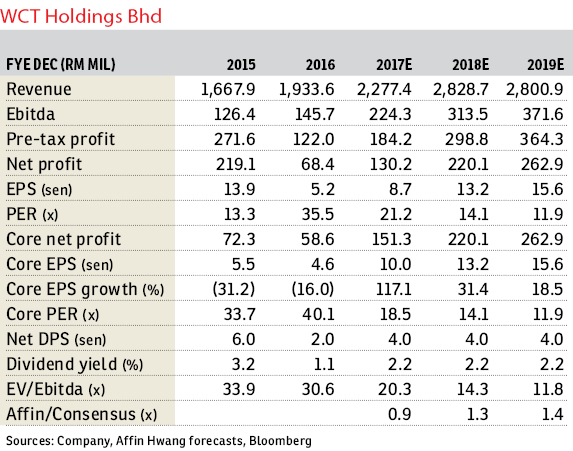

WCT targets to reduce its net gearing to 0.5 times to 0.6 times from 0.85 times currently by mid-2018. We reiterate our “buy” call with a TP of RM2.46. WCT’s proposed private placement of up to 140 million new shares (10% of share capital) came as a surprise.

This was less than seven months after raising RM178 million from an earlier private placement of 100.5 million new shares at RM1.77 on March 29, 2017.

Timing of issuance could be 2% of share capital by end-2017 and another 8% of share capital from April 2018 at the earliest due to the limit of private placement issuance equivalent to 10% of share capital within a year.

WCT could raise up to RM240 million in proceeds. If the remaining WCT-WD warrants are exercised at RM1.71 per share, raising about RM200 million, this could alleviate the need to issue shares.

WCT may consider injecting the Paradigm Johor Bahru Mall into the proposed WCT REIT to be listed in mid-2018, if the mall does well after opening. This could potentially double the total asset size of the REIT to RM2 billion.

WCT is close to completing negotiations with AEON Credit Service (M) Bhd to extend the BBT Mall lease for another five years, improving the yield on the asset.

WCT still had inventories of properties worth RM644 million at end-2Q17, which could balloon to RM1 billion due to construction completion by end-2017 if not sold. WCT is pushing sales by improving its marketing strategy and giving higher rebates. We believe the correction in the share price provides an opportunity to accumulate the stock in light of improving long-term prospects. WCT is one of our top-sector “buys” with a 12-month TP of RM2.46. — Affin Hwang Capital, Oct 27

This article first appeared in The Edge Financial Daily, on Oct 30, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

The Sky Residence @ Shamelin

Cheras, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Bukit Jalil, 2.5 Storey house (end lot), Taman Jalil Sutera, Kuala Lumpur

Bukit Jalil, Kuala Lumpur

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor