CapitaLand Malaysia Mall Trust (Oct 26, RM1.45)

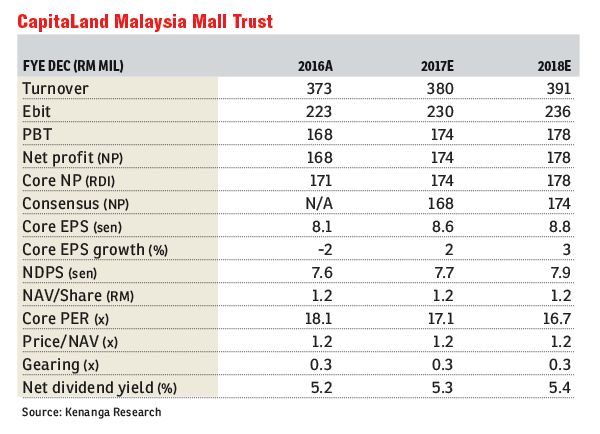

Maintain outperform with a target price of RM1.63: CapitaLand Malaysia Mall Trust’s (CMMT) realised distributable income (RDI) for the first nine months of financial year 2017 (9MFY17) of RM126.6 million met both our and market expectations at 73% and 76%, respectively. No dividends were declared as expected. We maintain our earnings estimates of RM174 million and RM178 million for FY17 and FY18. We like CMMT as most downsides have been priced in and valuations are attractive (at 6%/5.4% gross/net yields) versus peers (5.5%/5% gross/net yields).

CMMT’s 9MFY17 gross rental income (GRI) declined slightly by 0.8% mainly due to: i) lower GRI at Sungei Wang Plaza on negative reversions but better than the negative reversions in the first quarter of FY17 (1QFY17) and 2QFY17; ii) lower GRI at The Mines shopping mall due to negative reversions and lower occupancy; and iii) lower GRI at Tropicana City Mall due to lower occupancy at the office tower, but this was mitigated by contributions from the Gurney Plaza and East Coast Mall. All in, RDI declined marginally by 1.4% as earnings before interest and tax (Ebit) margin was flattish at 59.5%. Quarter-on-quarter, GRI was flattish at 0.9% on stable occupancy of 95.8% and as rental reversions improved to -1.8% (2QFY17: -4.5%). This translated into a bottom-line growth of 1.1% as Ebit margin was also stable at 59.5%.

Management plans to spend RM30 million on capital expenditure in FY17 for general refurbishment at the Gurney Plaza and Tropicana City Mall, and another RM70 million in FY18 for the Sungei Wang Plaza and East Coast Mall, which we have imputed into our estimates. FY17 and FY18 will see 43% and 34% of leases up for expiry, of which we expect modest single-digit reversions. Meanwhile, The Mines may continue to see weak reversions, while Sungei Wang Plaza may not see positive rental reversions in the near term, which we have already accounted for in our forecasts but we expect it to continue improving now that the mass rapid transit line 1 (MRT1) is operational, and further on improved mall accessibility in FY18.

Most of the downside risks for CMMT have been factored into our earnings and valuations, while a potential catalyst is recovery in reversions mostly at Sungei Wang Plaza now that the MRT1 is completed. That said, we are comfortable with our “outperform” call as valuations appear attractive at 6% gross yields (5.4% net yields) currently versus its peers of 5.5% (5% net yields). — Kenanga Research, Oct 26

This article first appeared in The Edge Financial Daily, on Oct 27, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Trio by Setia

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Kenny Hills (Bukit Tunku)

Kenny Hills (Bukit Tunku), Kuala Lumpur