Sunway Construction Group Bhd (Oct 13, RM2.31)

Maintain buy with an unchanged target price (TP) of RM2.59: Sunway Construction Group Bhd (SunCon) was awarded a RM74.8 million subcontract from Ahmad Zaki Sdn Bhd for works at the Bukit Bintang City Centre.

The job scope involves earthworks, piling, diaphragm wall, reinforced concrete works, “pencawang masuk utama” and “pencawang pembahagian utama” works over a period of 10 months.

Apart from that, SunCon also received a letter of intent from Chiu Teng Construction Co to supply precast components for the Clementi Neighbourhood 2 comprising 1,179 dwelling units for a contract sum of S$20.9 million (RM65.2 million) over a delivery period of 21 months.

SunCon’s year-to-date (YTD) job wins now total a record RM3.7 billion (excluding the mass rapid transit second phase stations which are already accounted for as part of the main viaduct line). This amount has surpassed management’s initial guidance of RM2 billion.

Over the last two months, SunCon had managed to secure two sizeable jobs which are the light rail transit Line 3 (RM2.2 billion) and the 1Malaysia Civil Servants Housing (RM582 million).

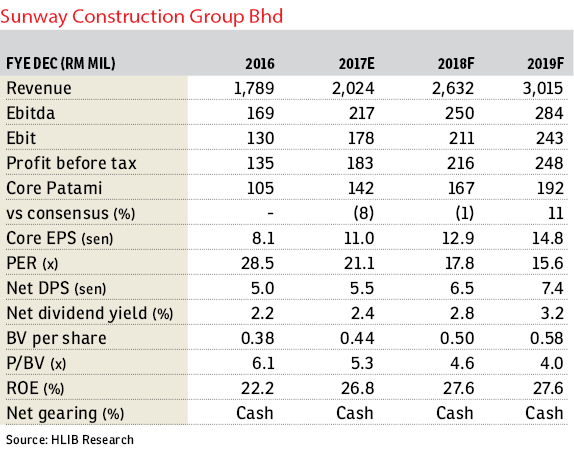

Coupled with these two recent contracts announced, SunCon’s order book has surged by 56% to an all-time high of RM6.7 billion (compared with RM4.3 billion as of the second quarter of financial year 2017 [2QFY17]). This implies a strong cover of 3.7 times on FY16 revenue, providing strong earnings visibility over the next three years. With its all-time high order book, execution would be the key risk.

On forecast, it is unchanged as YTD job wins of RM3.7 billion have met our full-year assumptions. Any further job wins for FY17 would provide upside to our earnings forecast.

SunCon continues to surprise us positively with its contract winning capability leading to a strong surge in its order book. We like SunCon as a well-managed contractor with strong execution ability.

Our unchanged TP of RM2.59 is based on a 20 times price-earnings multiple tagged to FY18 earnings.

We reckon that our premium valuation yardstick for SunCon is justified given its superior return-on-equity of 27%, which is more than double of its peers’ average, and healthy balance with a net cash position of RM364 million (28 sen per share). — Hong Leong Investment Bank Research, Oct 13

This article first appeared in The Edge Financial Daily, on Oct 16, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Bandar Springhill

Port Dickson, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

SAUJANA INDAH @ S2 HEIGHTS

Seremban, Negeri Sembilan