Kerjaya Prospek Group Bhd (Sept 19, RM3.85)

Maintain underperform with an unchanged target price (TP) of RM3.30: Kerjaya Prospek Group Bhd has recently announced that it had secured a new building project worth RM291 million from Bon Estates Sdn Bhd. This project is also known as “The Estates”, which encompasses construction of the main building, hardscape works, external works and other ancillary works for two towers of residential high-rises with 46 storeys each totalling 328 condominium units along with a three-storey podium for recreational facilities to be built on top of a 4½-level basement car park in Bangsar South, Selangor, slated for delivery in May 2020 (32 months).

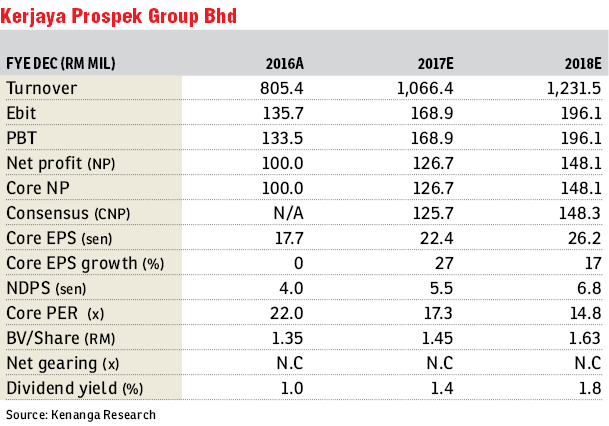

Despite Kerjaya’s year-to-date (YTD) wins of RM1.15 billion, surpassing our RM1.1 billion financial year 2017 (FY17) replenishment target, we remain neutral given that it is only slightly above our target, accounting for 104% of full-year target. Also, note that we are entering the tail end of FY17 and this contract is still within our FY18 replenishment target of RM1.2 billion. However, should Kerjaya clinch another major contract with value exceeding RM200 million by year end, we would look to adjust our FY18 replenishment assumption upwards. Assuming a pre-tax margin of 16%, this newly won contract will contribute about RM13.1 million to Kerjaya’s bottom line per annum.

Currently, Kerjaya’s outstanding order book stands at RM3.15 billion, giving it a visibility of about 2.5 years. Meanwhile, tender book stands at about RM900 million while we believe further project wins could likely stem from Datuk Tee Eng Ho and Tee Eng Seng’s private property arm that is planning to launch a mixed-development project in Old Klang Road with a gross domestic value of RM1 billion leading to about RM300 million to RM400 million worth of contracts to be dished out, which would likely happen in FY18. Besides that, we believe Kerjaya could possibly undertake a one-for-one bonus issue as the Companies Act 2016 states that share premium account will no longer be applicable from FY18 onwards and Kerjaya has a high share premium of RM333 million versus a share capital of RM258 million (as of the second quarter of FY17).

We maintain our sum-of-parts-derived TP of RM3.30 and reiterate our “underperform” call as we feel that Kerjaya’s risk-to-reward ratio is no longer compelling as its share price is up 79% YTD and trading at FY18 price-earnings ratio (PER) of 14.8 times and also implying a FY18 construction PER of 15.5 times, which we consider high given that it is above our ascribed range of nine to 13 times for small mid-cap contractors within our universe. — Kenanga Research, Sept 19

This article first appeared in The Edge Financial Daily, on Sept 20, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Subang Hi-tech Industrial Park

Subang Jaya, Selangor

The Park Sky Residence

Bukit Jalil, Kuala Lumpur

Serena, Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor