Mah Sing Group Bhd (Sept 11, RM1.47)

Maintain buy with an unchanged target price (TP) of RM1.76: After taking a two-year break, Mah Sing Group Bhd has renewed its acquisition trail, leveraging on its solid balance sheet and the availability of prime land with reasonable pricing in the current soft market. Year to date, the group has locked in four land deals with a combined gross development value (GDV) of approximately RM4.3 billion. With the new acquisitions, it has a strong portfolio of projects with a combined potential GDV and unbilled sales of approximately RM29.5 billion. Assuming annual sales of RM2 billion to RM3 billion, we estimate it would sustain the group’s revenue for the next 10 to 15 years.

Despite having a replenished GDV of RM4.3 billion to date, the group has publicly expressed its intention to look for more landbanking opportunities. As at June 2017, the group’s balance sheet was in a net cash position with a total cash pile of RM1.5 billion. Factoring in the acquisition cost of the new land mentioned above and other capital commitments, we estimate the group’s net gearing ratio to remain relatively low, which is less than 0.2 times. As such, we anticipate more land acquisitions over the next six to 12 months. In terms of location preference, we gather it will be focusing on acquiring more land in Greater Kuala Lumpur as property demand in this region remains resilient, driven by population and economic growth. Over the next two to three years, management aims to increase the group’s outstanding GDV in the Greater Kuala Lumpur area to 75% from 67% currently.

Management is maintaining its 2017 sales target of at least RM1.8 billion. Recall that Mah Sing recorded sales of RM819 million in the first six months of financial year 2017 (1HFY17), a year-on-year increase of 6.5%. We believe the group’s sales target is achievable, as its 1HFY17 sales already made up about 46% of its sales target. For 2HFY17, new sales are expected to be supported by RM1.7 billion worth of new launches. In addition, we also understand that the group’s recent launches have received encouraging responses. For instance, it launched the Fern, phase three of its Bandar Meridian East in early July, offering 394 units of two-storey link homes with built-ups starting from 1,622 sq ft. Priced at about RM363,000 per unit, we gather that 50% of the units have been taken up. This suggests that demand for landed properties in the Iskandar region remains healthy.

There is a potential upside to the group’s sales target of RM1.8 billion, as we understand that the target was set before the group announced the four land deals for this year. Hence, we believe that M Centura @ Sentul and M Vertica @ Cheras have not been budgeted in 2017 sales. The group has recently completed the acquisition of the M Centura land and we believe it is on track for launch in the fourth quarter ending Dec 31, 2017 (4QFY17). M Centura, which is planned to be affordably priced, will feature two blocks of serviced apartments of over 1,400 units with indicative built-ups of 650 sq ft, 850 sq ft and 1,000 sq ft. We understand that the apartments will be priced from RM326,000 per unit (or RM500 per sq ft [psf]). As for M Vertica, a sales gallery was set up in July 2017 and preview sessions are underway. Scheduled for official launch in 4QFY17, M Vertica consists of five blocks of serviced apartments with over 3,600 units, with indicative built-ups of 850 sq ft to 1,000 sq ft. The units are affordably priced from RM450,000 per unit (or RM529 psf). Given its strategic location and attractive pricing, M Vertica has received more than 8,500 registrations of interest.

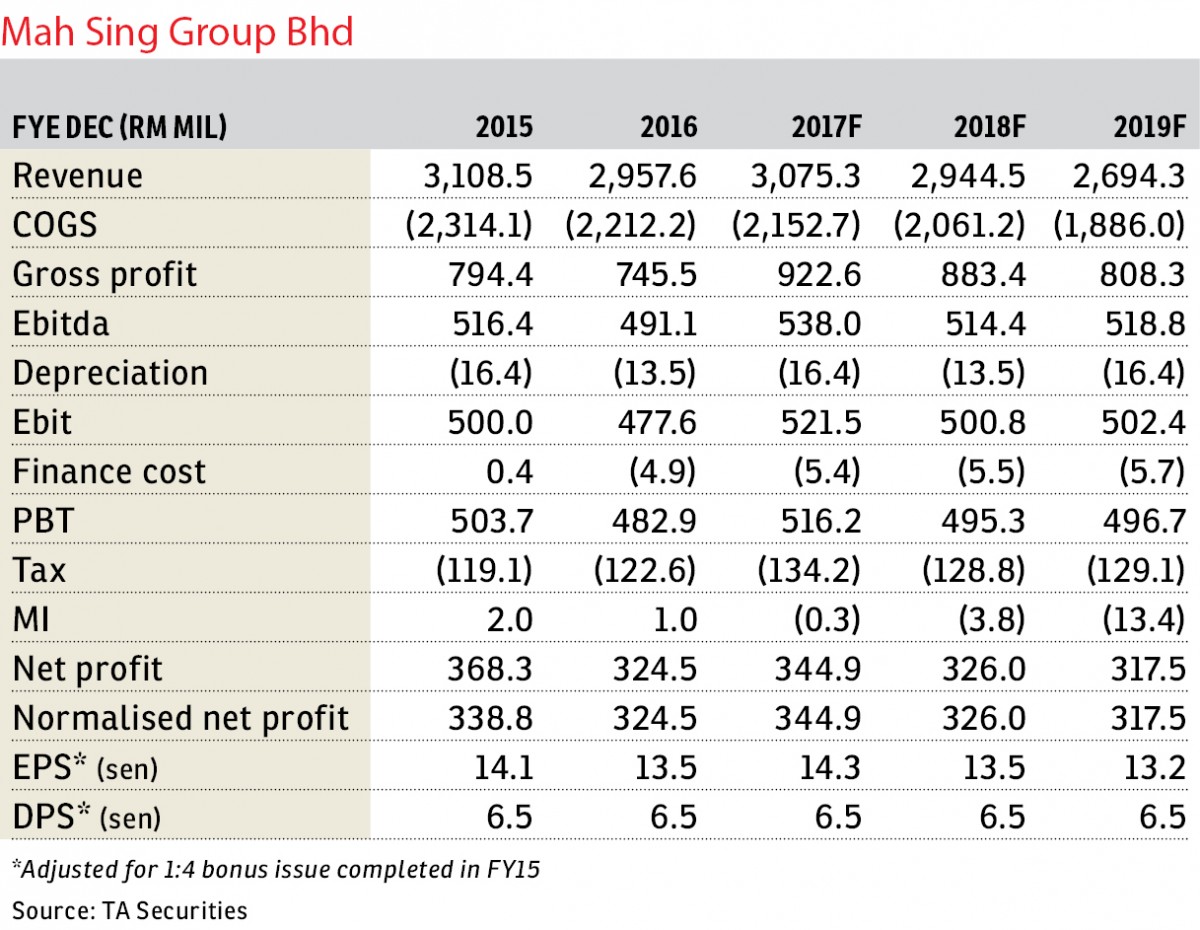

We made no changes to our FY17 to FY19 earnings forecasts. Unbilled sales of RM3 billion should sustain the group’s earnings for more than 12 months. Our FY17/FY18/FY19 sales assumptions are RM1.9 billion/RM2.5 billion/RM2.7 billion respectively. We maintain our TP of RM1.76 per share, based on unchanged 13 times calendar year 2018 earnings per share. We continue to like Mah Sing’s healthy balance sheet and focused strategy to provide mass-market housing in urban regions. With a potential total return of 24.1%, we maintain Mah Sing as “buy”. — TA Securities, Sept 11

This article first appeared in The Edge Financial Daily, on Sept 12, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Bukit Jalil, 2.5 Storey house (end lot), Taman Jalil Sutera, Kuala Lumpur

Bukit Jalil, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Mawar, Bandar Baru Salak Tinggi

Sepang, Selangor