Construction sector

Maintain overweight: Domestic contract awards to listed contractors in the second quarter of 2017 (2Q17) amounted to RM4.1 billion (-39% quarter-on-quarter [q-o-q], -49% year-on-year [y-o-y]). Sizable job wins were lacking during the quarter with only one contract exceeding RM500 million (the Bintulu Port supply base wharf). In comparison, contract awards in 1Q17 (RM6.6 billion) and 4Q16 (RM6.8 billion) were boosted by several mass rapid transit Line 2 (MRT2) viaduct packages.

On a cumulative basis, the first half of 2017 (1H17) domestic contract awards totalled RM10.7 billion, declining 72% y-o-y. The steep fall was attributed to an exceptionally high base last year due to the award of the MRT2 underground works (RM15.5 billion), the Duta–Ulu Klang Expressway 3 (RM3.7 billion) and Pan Borneo Highway in Sarawak packages (RM3.2 billion).

We expect the flow of contract awards to pick up in 2H17, aided by the roll-out of the light rail transit Line 3 (LRT3) (RM9 billion). Channel checks with contractors reveal that several tenders have been called and are undergoing evaluation.

Given the significantly higher base for 2016 at RM56 billion (an all-time high), we expect a downward normalisation in 2017 to RM25 billion.

With 1H17 numbers forming 43% of our full-year target and expectations of a stronger 2H17, we reckon this target is on track. Despite the downward normalisation expected in 2017, this remains at the higher end of the historical range from 2009 to 2015 of RM10 billion to RM28 billion.

We reckon that job flows could pick up strongly next year fuelled by the impending roll-out of mega rail projects such as the East Coast Rail Link (RM55 billion), Kuala Lumpur-Singapore High-Speed Rail (RM60 billion) and MRT3 (RM50 billion).

Foreign contract flows in 2Q17 stood at RM631 million (+31% q-o-q, -20% y-o-y), bringing the 1H17 sum to RM1.1 billion (+3% y-o-y).

Risks are a soft domestic property market, leading to slower private-sector contracts.

We expect a strong revival in job flows next year, driven by the several mega rail projects. The significance of these mega rail projects to the construction sector should not be underestimated. To illustrate, job wins hit a high of RM28 billion in 2012 and RM56 billion in 2016 when MRT1 and MRT2 were rolled out.

Gamuda Bhd (buy; target price [TP]: RM6.24) is our top large-cap construction pick as it is set to see earnings hit multi-year highs in financial year 2018 (FY18) and FY19.

For the small caps, we like George Kent (M) Bhd (buy; TP: RM5.60) and Pesona Metro Holdings Bhd (buy; TP: 81 sen) as they both offer superior earnings growth and strong return on equity. — Hong Leong Investment Bank Research, July 7

This article first appeared in The Edge Financial Daily, on July 10, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

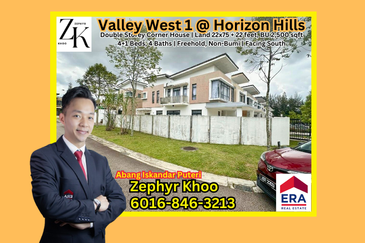

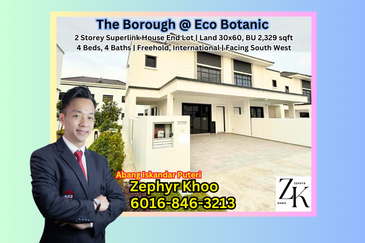

Eco Botanic

Iskandar Puteri (Nusajaya), Johor

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Bukit Jalil, 2.5 Storey house (end lot), Taman Jalil Sutera, Kuala Lumpur

Bukit Jalil, Kuala Lumpur

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Mawar, Bandar Baru Salak Tinggi

Sepang, Selangor