UOA Development Bhd (May 26, RM2.69)

Maintain market perform with a target price of RM2.63: UOA Development Bhd has proposed to acquire 2.39 acres (0.97ha) of freehold commercial land in the Bangsar South area for RM81.1 million (RM778 per sq ft) from Suileem Realty Sdn Bhd. The land can be used for commercial or serviced apartments — it already has an existing development order, but UOA Development will likely resubmit for changes. We gather that the land is located behind UOA Development’s ongoing South View project.

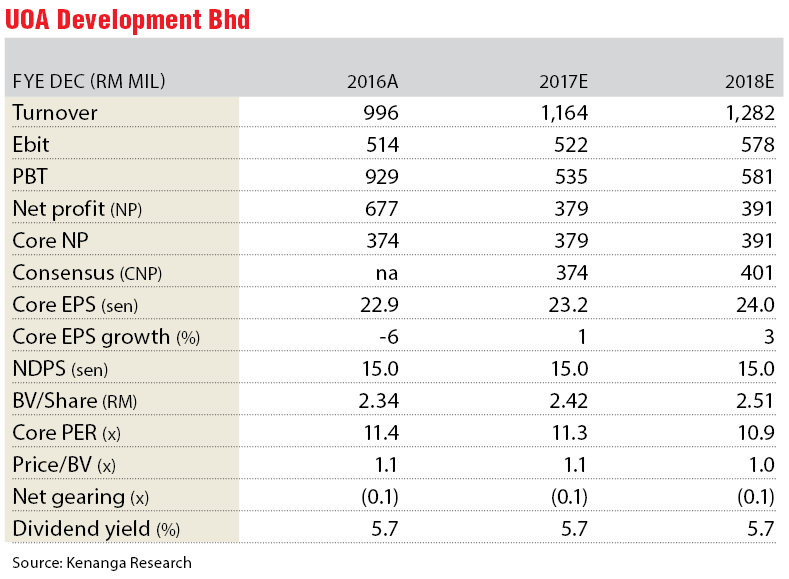

It has been a while since the group’s last land acquisition, and we welcome the gross development value (GDV) replenishment at UOA Development’s home turf Bangsar South. Also, the group is firmly in a net cash position with plenty of room for landbanking, and thus, we are not entirely surprised. Post-acquisition, UOA Development will remain in a net cash position of 0.09 times (from 0.11 times) in financial year 2017 (FY17).

Management has not provided any GDV or project detail as it is still in preliminary planning stages. UOA Development has another piece of undeveloped land adjacent to South View measuring 1.92 acres with a GDV of RM1.21 billion, implying a GDV per acre of RM583 million, although we note that the site has frontage of Federal Highway (we did not use South View GDV/acre as a comparison as it was launched much earlier). Assuming a slightly more conservative GDV/acre of RM500 million, the said land could have a potential GDV of RM1.2 billion. There was no proper comparable land available to us, but we reckon the land price is attractive as long as the project has a minimum GDV of RM810 million; this would imply a land cost-to-GDV ratio of 10%, which would enable the group to sustain its current gross margins.

UOA Development’s FY17 launch pipeline of RM1.69 billion comprises last phases of Sentul Point (GDV: RM500 million) and United Point (GDV: RM500 million) as well as new projects like the Bandar Tun Razak, Cheras (RM300 million) project and affordable homes in Selayang (RM90 million). It also includes a potential en bloc sale from the nearly completed Desa Commercial Center (RM300 million). Expected project deliveries in FY17 include South View, Southbank, Desa Sentul Phase 1 and Suria North Kiara. — Kenanga Research, May 26

This article first appeared in The Edge Financial Daily, on May 29, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Bukit Gasing, Seksyen 5

Petaling Jaya, Selangor

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu

RIMBUN IRAMA @S2 HEIGHTS

Seremban, Negeri Sembilan

RIMBUN IRAMA @S2 HEIGHTS

Seremban, Negeri Sembilan

RIMBUN IRAMA @S2 HEIGHTS

Seremban, Negeri Sembilan

Unicity Serviced Suites

Seremban, Negeri Sembilan

HIJAYU 3A @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan